25th June – 1st July 2018

- Date: 25/06/2018

Front and centre of our thoughts this week include

For what is a relatively quiet week for economic data, the highlight is probably the latest inflation numbers we receive for the US on Friday in the form of the May PCE report. Core PCE, which is the Federal Reserve’s favoured inflation measure, is expected to tick up marginally to an annualised rate of 1.9%. Considering the Fed has now signalled four interest rate rises this year, it will be a closely watched release. Thursday we will also get the final first-quarter GDP number for the US, with the annualised rate expected to remain at 2.2%.

The UK will be joining the US with the final first-quarter GDP growth release as well, although it is expected to stick at the less-than-impressive annualised rate of 1.2%. That’s pretty much all we get from the UK in terms of economic data, however we expect no shortage in terms of Brexit newsflow as Prime Minister Theresa May prepares to travel to Brussels this week for an EU summit. As well as discussing Brexit, another key topic will be on impending trade wars as the EU weigh up retaliatory measures against the US.

Staying with the Euro area, we will be paying close attention to their release of inflation data on Friday, which will give us a first look at CPI for June. Current consensus for core CPI, the preferred metric for the European Central Bank (ECB) due to stripping out more volatile food and energy prices, is for it to drop back a touch to an annualised rate of 1.0%. Consumer confidence for the region is also released Tuesday morning, which is expected to remain stalled at the current level – perhaps unsurprisingly, considering the relative weakness of data this year.

Wrapping up with a couple of final pieces that are worth keeping an eye out for, are the latest unemployment rates for both Germany and Japan – both toward the tail-end of the week

In the rear view mirror of last week we saw

The highly-anticipated Bank of England (BoE) meeting last Thursday concluded by maintaining interest rates at 0.50%, which was certainly expected. What was a little less expected was that three of the Monetary Policy Committee (MPC) members, including the bank’s Chief Economist Andy Haldane, voted to raise rates to 0.75%. Although the three votes clearly weren’t enough for this meeting (there are nine members in total), it seems to have increased the chances of an interest rate rise at their next meeting in August, with the market-implied probability up above 65%, according to Bloomberg.

Unsurprisingly, financial markets were dominated by newsflow surrounding increasing trade tensions last week. As a quick recap of the ever-evolving situation, we kicked off the week with US President Donald Trump threatening new tariffs on $200bn of Chinese imports, the European Commission then announced on Wednesday that the EU will impose tariffs on hundreds of US goods, including bourbon, jeans and motorbikes, before finally Donald Trump threatening to impose tariffs of 20% on imports of cars from the EU.

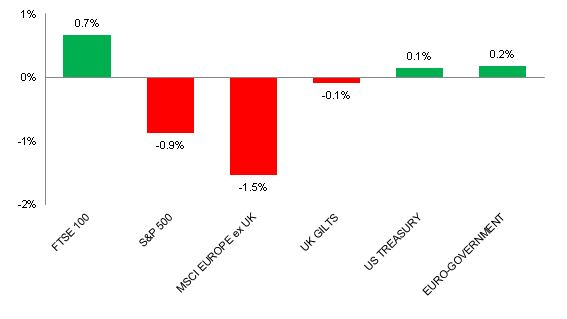

Oil had a very strong week following the meeting between OPEC and non-OPEC members. The oil price rose over 3% on Friday, as they signalled a smaller than expected increase in oil production. As a result, it saw the UK’s FTSE 100 index finish the week strongly relative to other regions, as the oil-heavy index benefitted from the rising oil price.

Recapping some of the economic data released last week, on the whole it was fairly strong when looking at the economic health indicators in the form of PMIs. The Euro area in particular was a highlight due to its strength, while the US and Japan also posted strong readings.

In the side view mirrors of corporate activity we notice

European aerospace company, Airbus, announced that it is preparing to abandon plans to build aircraft wings at its British plants by moving production to China, the US or somewhere else in Europe. A lack of clarity in terms of what a post-Brexit Britain will look like was cited as the reason. The UK government held talks to try and resolve the situation, however regardless of how that goes, it’s undeniably going to be the feeling amongst other UK businesses and is perhaps a warning sign of what is to come.

Asos shares fell by as much as 5% on Friday, as the US Supreme Court overturned a ruling allowing e-commerce companies to avoid collecting sales tax from customers. The ruling essentially means that states have the right to impose sales tax on online sales, irrespective of whether the retailer has a physical presence in the territory or not. Peers, such as Boohoo and Ebay, also fell.

Source: Bloomberg. Figures are for the period 18th June to 24th June 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.