8th October – 14th October 2018

- Date: 08/10/2018

Front and centre of our thoughts this week include

The week after the US employment report tends to be a quiet affair and true to form, this week is a little light on data. The highlights however include CPI inflation numbers from the US, trade data out of China and the start of the third quarter corporate earnings results in the US.

Inflation in the US has been trending upwards which alongside robust economic data has driven US government bond yields higher. Inflation is expected to continue to increase this week with core inflation, which strips out the volatile food and energy component expected to rise to an annualised rate of 2.3% in September. This should strengthen the case for the US Federal Reserve to raise interest rates again in December. More importantly, alongside trade tariffs, higher oil prices and rising wage pressures, will add to a growing list of economic indicators which show inflationary pressures are continuing to build within the US economy - a result which could act as a catalyst for government yields to continue to move higher this week.

Over in China, trade data for September is released, with investors keeping a close eye for any signs of the impact of tariffs on the trade numbers. Chinese exports slowed last month, however it’s too early to conclude that this was entirely the result of tariffs as it will likely take some time before the disruption to supply chains is reflected in the data. Furthermore, a number of Chinese companies are believed to be front-loading orders in an attempt to avoid future tariffs which should provide a boost to this month’s figures. Nevertheless, with Chinese economic data on a weakening trend, a below expectation export number will likely worsen investor sentiment towards Chinese growth and the broader emerging markets space at an already challenging time for the asset class.

Lastly, this week sees the start of the third quarter corporate earnings reports for US companies, with seven S&P 500 companies set to report results, including global banks JP Morgan, Wells Fargo and Citigroup. Corporate tax cuts continue to provide a boost to the year on year comparison in earning figures, consequently the more interesting component of the reports will be management’s guidance and expectations for earnings heading into 2019. Going on in the engine of Brexit

The Conservative Party Conference in Birmingham takes centre stage this week and it is set to be a nervy affair for Prime Minister, Theresa May. Her closing speech on Wednesday is set to be the highlight of the week.

Talk of a leadership contest has been relatively quiet of late as Brexiteers have lacked the numbers to oust the Prime Minister. However, with the Conservative Party lacking clear direction on Brexit and suffering from permanent infighting, her tenure as leader looks likely to be brought into question this week.

Over the last couple of weeks, the pressure has certainty been ramped up on Mrs May. The EU rejected her Chequers Plan in Salzburg, Boris Johnson rallied the Brexiteers within her party with his “Super Canada” trade proposal and the Labour Party have agreed to vote against almost all trade deals she negotiates with Brussels. Any hope she had of agreeing a fudged or blind Brexit deal and postponing hard choices to a later date appear to have been blown apart. Investors will therefore be keeping a close eye on her speech on Wednesday for any signs that she will shift negotiations away from her Chequers proposal. The message so far has been defiant - with Mrs May stressing the Chequers deal remains the best plan for the country.

In any case, whatever plans for negotiations with Brussels are agreed at the conference, with no parliamentary majority for any potential Brexit deal, the probability of a no-deal continues to creep higher.

Going on in the engine of Brexit

Theresa May made it through the Conservative Party Conference relatively unscathed. However more hard work lies ahead for the Prime Minister. With less than two weeks to go until the next EU summit, her team must come up with a breakthrough in talks. The key stumbling block remains the Northern Ireland backstop - the legal guarantee that whatever happens in future trade talks, there will be no hard border on the island of Ireland.

Brexit Secretary, Dominic Raab heads to Brussels this week with various press reports suggesting he is set to present a new proposal for the Irish backstop which keeps the entire UK within a Customs Union. EU officials have been lukewarm to this idea as they believe it could act as a back door for the UK to remain in the EU trade regime, but without any of the obligations of membership. In any case, even if this proposal is agreed, the real challenge remains passing the deal through parliament.

In the rear view mirror of last week we saw

It was another strong week for US economic data. The Institute for Supply Management (ISM) non-manufacturing index, a key gauge of optimism within the US service sector industry, rose to the highest level since 2008. The September employment report was also much stronger than the headline jobs creation number suggested. Whilst the US economy created fewer jobs than expected in September (134k vs 185k), Hurricane Florence likely affected employment in some industries and it comes in the context of the number of jobs created in the previous two months being revised higher. The unemployment rate fell to 3.7%, the lowest level since 1969, the year when Neil Armstrong went walking on the moon. While wage growth this month dipped slightly from the previous month, the broader trend of higher wages remains intact.

In Brazil, the first round of the presidential elections took place over the weekend and far-right candidate, Jair Bolsonaro emerged as the clear victor, winning 46% of the votes. This was far more than his closest rival, socialist Fernando Haddad of the Leftist Workers Party who gained 29% of the vote. Unfortunately, for Bolsonaro, the results did leave him just short of the 50% needed to win outright at the first stage of the election and he must now face Haddad in a second round of votes on October 28th. Bolsonaro popularity rose after he was stabbed during the campaign process. However, he remains a controversial figure. He has pledged tough punishments for offenders and relaxation of gun ownership rules, whilst historically he has made sexist, homophobic and racist remarks.

In the side view mirrors of corporate activity we notice

Online retailing giant Amazon announced that it is set to raise the minimum wage for employees in the US to $15 and £9.50 for staff in the UK, with a higher wage set for those in London. The company’s CEO, Jeff Bezos is also lobbying for the US government to raise the federal minimum wage. Whilst the announcement appears sincere enough, investors have questioned if there is an ulterior motive at play. Amazon has been investing heavily in technology and automation whilst its bricks and mortar rivals rely heavily on low paid workers. By pushing for higher minimum wages, Amazon puts pressure on his rivals, like Walmart, by bumping up their costs. Furthermore, the announcement was not all good news for employees as Amazon scrapped bonuses and stock awards as part of their new pay package.

Unilever has abandoned its plans to scrap its dual-listed structure and move its headquarters to the Netherlands after it failed to gain enough shareholder support for the move. The announcement is major victory for UK shareholders. Had Unilever shifted its headquarters to the Netherlands, under UK rules, it would have been no longer eligible to be a member of the FTSE 100 index. This would have forced passive funds that track the stock market (and some active UK fund managers) to sell their holdings in the stock.

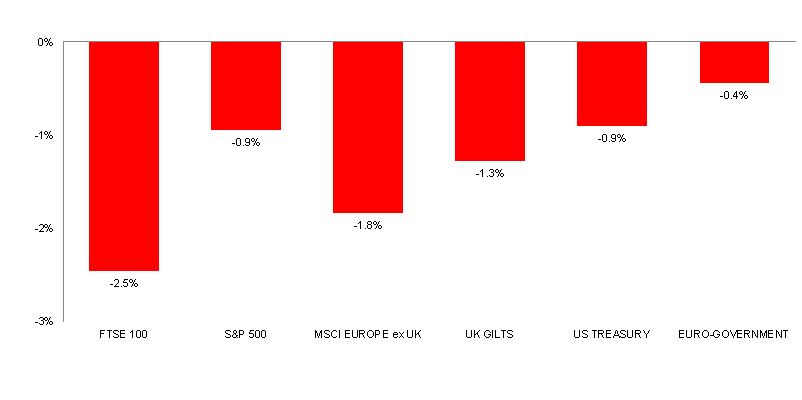

Source: Bloomberg. Figures are for the period 1st October to 5th October 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.