Pensions Schemes

We offer innovative investment solutions to the Trustees and sponsors of defined benefit schemes.

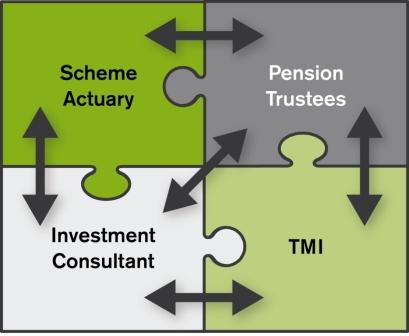

Working alongside respected, independent pension investment consultants, we combine our portfolio building expertise with the consultant’s ability to quantify and monitor each pension scheme’s liabilities.

Our pension scheme solutions are designed to provide a scheme with guidance and direction on their investment strategy, as well as preparing a roadmap that will chart the movement of their investment portfolio against their liabilities. This enables the scheme to react to both movements in its liabilities and in the financial markets in a much more focused and timely manner.

The benefits of our pension scheme offering include

- A greater understanding for Trustees of their scheme’s true position on an ongoing basis

- A tailored solution that focuses on reducing the deficit and meeting the pension scheme liability

- The solution provided at a competitive fee level

How each party interacts: