29th October – 4th November 2018

- Date: 29/10/2018

Front and centre of our thoughts this week include

Equity markets took another beating last week, with the S&P 500 hovering around correction territory, i.e. a 10% fall from its recent peak. Market corrections should not be too surprising given that statistically they happen, on average, once a year. What has surprised us, however, is the fact this correction has occurred during a period where US companies are reporting annual earnings growth, on average, of over 20%. It seems to us that these stellar earnings have intensified end of the cycle fears as they have most probably peaked now as the tax cuts start to fade out as we move into 2019.

Our focus remains on how near we are to the end of this cycle, with particular attention on the US Federal Reserve’s (Fed) interest rate hiking cycle. As such, a highlight this week is undoubtedly the US unemployment report this Friday. Wage growth has arguably been one of the most important metrics to watch when trying to gauge inflationary pressures and, as a result, the future path of interest rates. Consensus is for wages to grow at an annualised rate of 3.2%, which would be the highest since 2009 and give the Fed confidence in continuing their gradual increases in interest rates – despite US President Donald Trump having labelled current rates as “too aggressive”.

Ahead of Friday, though, the UK will be in focus with a couple of significant events. Today we have the latest Budget, marking exactly five months before we officially leave the European Union (EU) – at least, for now. With Prime Minister Theresa May announcing the end of austerity, there will be particular scrutiny on how far Chancellor Philip Hammond loosens the purse strings.

Thursday then sees the Bank of England’s (BoE) Monetary Policy Committee (MPC) meet. As we remain in a Brexit-driven uncertain time in the UK, it remains unlikely the BoE will make any changes to interest rates. Following the meeting, however, they will also be releasing their latest inflation report, which will result in some volatility in sterling if we see any significant deviation from previous forecasts. Having said that, we won’t be placing too much emphasis on the report bearing in mind the path of future inflation will be largely dependent on the economic structure of the UK post-Brexit.

Key data will be released for the Eurozone this week, which will be worth keeping an eye on. Tomorrow we get a first look at the bloc’s GDP growth in the third-quarter. Expectations are for the economy to grow 1.8% versus the same quarter last year, which would be the slowest annualised growth rate since 2016 and would confirm a sharp loss of momentum for the Eurozone – it peaked at 2.8% last year. With economic growth having slowed, the Italian and now the German political situation becoming more volatile, investors are becoming increasingly concerned with the region that was widely loved by them at the beginning of the year. European Central Bank (ECB) President, Mario Draghi, did try to reassure investors last week (more on that below). Before the week is out, however, on Thursday, we also get the Eurozone’s latest unemployment and inflation reports.

Finally, as well as the BoE meeting this week, we also have the Bank of Japan (BoJ) meeting on Wednesday, although no changes are expected to be made to monetary policy.

Going on in the engine of Brexit

As speculation has grown regarding a vote of no-confidence for Theresa May, the Prime Minister has seemed to dissipate some of this pressure after a well-received speech to the 1922 Committee last week. She was met with applause as she pleaded with colleagues to back her Brexit plan and unite the party.

Hammond is also expected to pressure Eurosceptic MPs in his Budget today, warning that an effective end of austerity, including potential tax cuts and increased public spending, hinges on the UK securing a good Brexit deal. What this also means is that if there was a no-deal Brexit, then Philip Hammond has confirmed we would require a new emergency Budget.

The next key date to look out for is December 13th for the next EU Council meeting.

In the rear view mirror of last week we saw

Last week we watched the ECB meeting which saw Mario Draghi trying to reassure investors in the Eurozone. Although he confirmed economic growth in the Eurozone has lost some momentum, he did stop short of describing it as a downturn. Further to this, when quizzed on the Italian situation after the European Commission (EC) rejected Italy’s draft budget, the first time Brussels has rejected an EU member state’s draft budget, he stated he was confident a deal would be made.

The Italian situation has been a key story for markets and last week was no different. Credit ratings agency Standard & Poor’s (S&P) updated their rating for Italy, as well as its outlook for the EU member. Although it left the country’s credit rating unchanged, it did lower its outlook to “negative” from “stable” in light of Italy’s draft budget proposal that would see a substantial increase in the amount of debt issued by the government.

Friday saw the release of US third-quarter GDP growth, which showed the economy growing at an impressive annualised rate of 3.5%, better than the market expected. Economic growth in the US continues to be significantly stronger than their developed market peers as they benefit from strengthening consumer confidence and job market. As a result of the former, household spending was the strongest it’s been since 2014. There were some dark spots, including weaker business investment. However, this will undoubtedly please President Trump in the run-up to the US midterms – the economy firing on all cylinders can only help his cause in retaining both the House and the Senate.

Over the weekend, and coming into this week, the German political situation continues to falter. Both CDU and SPD, the governing coalition, suffered heavy losses in a regional election as the Green Party and AfD saw significant gains. The result has seen German Chancellor Angela Merkel confirm this morning that she will not run for re-election in December.

In the side view mirrors of corporate activity we notice

Advertising giant’s, WPP’s, recently appointed chief executive, Mark Read, gave a dismal trading update for the FTSE 100 Company last week – the reaction was brutal with the shares coming off around 14%. In an unsubtle dig at ousted chief executive Sir Martin Sorrell, he placed much of the blame on the business being too slow to adapt, being too complicated and under-investing. These all may be fair, although arguably it’s the structural challenges to the industry that have worried investors most, with companies able to reduce advertising costs by going direct to online platforms, such as Facebook. Shares have fallen 35% so far this year.

Against the odds, Tesla enjoyed their first quarterly profit in two years in the third quarter of this year, reporting a net income of $312 million. With the market expecting another loss, the update sparked a double-digit gain in the company’s share price. Shareholders will be hoping recent Elon Musk-related controversies are behind them, such as his recent Tweet misleadingly confirming he had funding sorted to take the firm private.

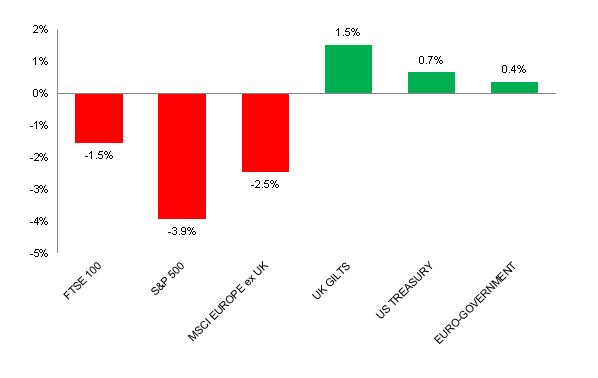

Source: Bloomberg. Figures are for the period 22nd October to 26th October 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.