28th August – 2nd September 2018

- Date: 28/08/2018

Front and centre of our thoughts this week include

There is not a huge amount to get excited about in this holiday shortened week, with relatively few major economic indicators released to keep investors on their toes. The highlights however include inflation and housing data from the US, a manufacturing confidence survey from China and consumer borrowing figures in the UK.

Starting off in the US, we receive the Core PCE index for July, the Federal Reserve’s (Fed) preferred measure of inflation. Expectations are that the year on year growth in the inflation measure will rise above 2%, which would be the first time the inflation measure has been above the Fed’s 2% inflation target since April 2012. This would be a result which may provide Fed committee members with the validation to continue with their gradual course of raising interest rates.

One part of the US economy that is susceptible to rising interest rates and could see the Fed alter its interest rate hiking path is the housing market. The housing market is one of the most interest rate sensitive parts of the economy and recent housing data has been on the softer side, in particular home sales. Elevated house prices and rising mortgage rates as well as a lack of available homes for sale have all been cited as reasons for the slowdown. Nevertheless, the weakness in recent housing data means that the new home sales figures for July have added significance as investors try to establish whether the recent softness is just statistical noise or the start of a more meaningful downtrend. Further weakness could make Fed committee members more cautious about raising interest rates going forward.

As we have mentioned previously, the ongoing trade war between the US and China means that Chinese economic data comes increasingly under the spotlight. This week sees the release of the Chinese manufacturing PMI confidence survey for August, which will show how business optimism has held up in the first full month since trade tariffs were introduced. Whilst we expect tariffs to weigh on business optimism, the Chinese government have recently relaxed fiscal and monetary policy in an effort to support the economy and it will be interesting to see which has had the greater influence on business confidence. Needless to say, a weaker reading may add to the anxieties over the impact of trade tariffs on growth.

In the UK, the highlight of the week will be the release of the Bank of England mortgage approvals and consumer credit figures for July. The housing market in the UK continues to be divided, with London and parts of the South East witnessing falls in housing transactions and prices whilst the rest of the UK looks relatively buoyant. However, the broader trend is that the momentum in the housing market is continuing to slow as affordability and a lack of houses for sale slow activity. If this trend persists, then household’s perception of wealth and confidence and subsequently consumption, may start to come under pressure. With regards to consumer credit, June’s figures showed that the UK consumer’s appetite for debt showed no signs of abating, with unsecured lending rising 8.8% over the year. Brexit aside, a slowing housing market and households continued binge on credit card borrowing present the biggest risks to the outlook for the UK economy, especially given the fact that the savings ratio in the UK continues to fall.

In other political news, it will be interesting to see how the Canadian government react to the news that the US and Mexico have reached a preliminary bilateral trade agreement, which is set to replace the existing NAFTA arrangement. The deal places additional pressure on Canada, the third partner in the original NAFTA deal to reach a similar agreement with the US. The US Government has added pressure on Canada by stating that they are prepared to go ahead with the Mexican deal with or without Canada’s participation.

In the rear view mirror of last week we saw

It was a troublesome week for US President, Donald Trump, as his reputation was further damaged and his reign as president came under threat due to news relating to his former lawyer and campaign manager. The president’s former lawyer, Michael Cohen pleaded guilty to violating campaign finance laws by arranging to buy the silence of two women Mr Trump allegedly had affairs with. Then his former campaign manager, Paul Manafort was convicted of tax evasion and bank fraud.

Both stories could have serious ramifications for the president and the Republican Party, with the US mid-term elections on November 6th only 70 days away. Current election polls suggest the Democrats are likely to win the House of Representatives, and a number of Democrat members have called for party leaders to initiate impeachment proceedings against the President if they do.

There was one bit of good news for the President, as the US stock market, as represented by the S&P 500 set a record for the longest ever bull market. The equity index has posted the longest stretch of rising prices (3,455 days) without suffering a 20% drop in prices – a decline which is typically associated with a bear market, beating the previous record set during the 1990-2000 bull market rally. The records do not end there, as if the S&P 500 finishes this year in the black, then it would be the tenth consecutive year of positive gains, a feat that has never been achieved in the history of the index. Whether this second record is achieved however could be closely tied to the fate of President Trump, as he warned last week that if he was to be impeached, then the stock market would “crash”.

In other news, Jerome Powell’s closely watched speech at the annual Jackson Hole symposium yielded little new information for investors. The Fed Chair used his speech to stress the importance of raising US interest rates at a gradual pace. He noted that the Fed are caught in a fine balancing act between raising interest rates too fast and shortening the economic expansion and conversely, lifting rates too slowly and risking “destabilising overheating”.

In the side view mirrors of corporate activity we notice

Food and beverage giant PespiCo has agreed to buy SodaStream, the maker of home-carbonation machines, for $3.2 million. The move follows the broader trend amongst global food and drinks companies to reposition their businesses towards healthier food and snacks, as health conscious consumers increasingly spend more money on these products and less on sugary fizzy drinks.

Alibaba, the Chinese technology giant with businesses ranging from ecommerce to financial services to cloud computing, suffered a rare bit of disappointment by reporting second quarter earnings that fell short of analysts’ expectations. Previously the company had beaten revenue and earnings estimates in the past eight quarters. The results showed that the company continues to grow revenues at a rapid pace in its e-commerce and cloud computing business but its costs have been increasing as it continues to battle for market share.

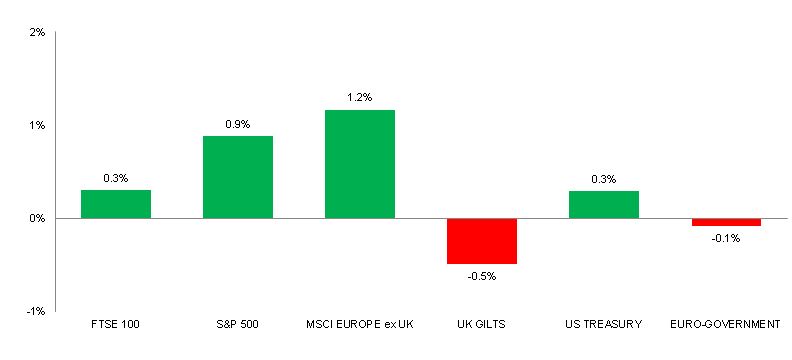

Source: Bloomberg. Figures are for the period 20th August to 24th August 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.