25th February – 3rd March 2019

- Date: 25/02/2019

Front and centre of our thoughts this week include

It will be the usual culprits of US-China trade negotiations and Brexit that will dominate headlines and investor sentiment this week. Politics aside, it’s also a busy week on the macroeconomic front with the highlight set to be the release of manufacturing PMI confidence readings from across the globe and US economic growth (as measured by GDP) figures for the fourth quarter of 2018.

The deadline for the US-China trade truce had been this Friday (1st March), however President Trump has agreed to extend the deadline due to “substantial progress” in negotiations. The latest developments suggest delegates from both sides are working on multiple memorandums of understanding that would form the basis on the deal, covering the key areas of agriculture, non-tariff barriers, services, technology transfer and intellectual property. A potential meeting between US President Trump and Chinese President Xi to sign off the deal being discussed for late March, depending on how talks progress.

In other political news, President Trump is due to meet North Korea leader, Kim Jong Un to discuss the North’s nuclear weapon program, with the US trying to achieve an exact timetable for denuclearisation. Press reports this morning suggest the leaders, alongside South Korea’s President, will declare the end of the Korean War at the summit.

Of all the Manufacturing PMI confidence readings released this week, China's will gain the closest attention. A material slowdown in Chinese growth remains one of the biggest risks to global growth. The Chinese government have recently implemented a number of fiscal and monetary policy measures to spur economic activity, and we have seen early evidence that this is starting to have a positive effect, with credit growth in January reaching record-high levels. Should we see a rebound in manufacturing confidence it will add weight to the view that the government’s stimulus measures will prove sufficient to boost economic activity once again. Given how vital Chinese growth is to export-orientated nations of Europe and Asian, this will likely provide a positive boost to global growth expectations.

Over in the US, the GDP estimate will show the extent to which the US economy slowed over the fourth quarter of 2018. As a reminder, in the second quarter of 2018, US economic growth reached a 4 year high of 4.2%, however growth has continued to slow since that date as the fading impact of fiscal stimulus and rising interest rates have taken their toll on the economy. Consensus forecasts predict the US economy grew at an annualised rate of 2.5% over the final quarter of 2018. This week also sees the release of the US Federal Reserve (Fed) preferred inflation measure, the PCE, for December. Given how closely tied the Fed's "patient" monetary stance is to the level of inflation, this indicator should provide a good gauge of the likely duration of the pause.

Going on in the engine of Brexit

Prime Minister, Theresa May has confirmed that there will be no meaningful vote on her revised Brexit deal this week, instead confirming she will bring her deal back to parliament for a second vote by March 12th.

As a result all eyes this week will be of a series of parliamentary votes that could force May’s hand in the Brexit process, with the Cooper-Letwin proposal gaining most attention. The Cooper plan is to give parliament the power to force a Brexit delay, if the government has not received approval for its Brexit deal in parliament, by March 13th.

If the Cooper-Letwin vote passes, then parliament will be given the ultimatum on March 12th to back the PM’s Brexit deal or risk the UK’s departure from the EU being delayed the very next day. In what might have been a key tactical ploy to gain support for May’s deal, press reports this morning suggest that the EU is recommending a 21-month extension to Article 50, in an attempt to get Brexiteers to support May’s deal. Should the Cooper plan not win a majority, then it’s back to May’s original plan of her deal or the default of no-deal Brexit on the 12th. In any case, whatever the outcome of the votes this week, expect the Brexit brinkmanship to go to the wire!

In the rear view mirror of last week we saw

Despite all the Brexit uncertainty, the jobs market remains a major bright spot for the UK economy. The UK added 167,000 people to the workforce between October and December 2018, whilst the unemployment rate remained at its lowest level since 1975, at 4%. Weekly wages (ex-bonuses) also rose 3.4% over the year, and when combined with falling levels of inflation is positive for households’ budgets. Recent economic data certainly seems to suggest that if the UK can avoid the alleged disastrous “no-deal” Brexit then 2019 could turn out to be a solid year for growth.

Over in the US, the minutes from the FOMC meeting held in January revealed that most policymakers supported a pause in interest rate rises until they gained a clearer view on the economy, adding that taking a pause posed “few risks” to economy at this point. Policymakers also set out guidance for the conditions required to raise rates again, notably inflation levels coming in higher than baseline forecasts as well as a stabilisation in US and overseas growth. However, the highlight of the minutes was the confirmation that “almost all participants” thought that it was desirable to end the Fed’s balance sheet reduction programme by the end of 2019. Under the Fed’s quantitative easing (bond purchasing programme) the size of their balance sheet ballooned from $900bn in 2009 to over $4trn at its peak in 2014.

Data last week appeared to support the Fed’s patient stance, with existing home sales and durable goods orders, a proxy for business investment, both disappointed. The preliminary manufacturing PMI confidence survey was also below expectations, and when added to the exceptionally weak retail sales for December seen last week, suggests the US economy has started the year in a sluggish fashion.

Elsewhere, the preliminary manufacturing PMI business confidence readings painted a pretty gloomy outlook for the global economy. Japan’s reading fell into contraction territory at 48.5, (a reading above 50 signals an expansion in activity whilst a reading below implies a contraction) for the first time since September 2016. It was a similarly bleak reading from the European reading, which came in at 49.2, its first contraction reading since 2013.

At current levels, these activity indicators suggest industrial growth in both respective reading is likely to remain weak. The one bright spot was the European service sector PMI reading, which increased slightly from 51.3 to 52.3, suggesting a modest rebound in service sector activity ahead.

In the side view mirrors of corporate activity we notice

In a further blow to the UK manufacturing and car industry, Honda announced that it will close its plant in Swindon by 2021. The announcement puts up to 7,000 jobs at risk (3,500 workers at the plant as well as a further 3,500 workers at affiliates primarily supplying the Honda factory). Management of Honda noted the closure was not Brexit related, but rather due to a slowdown in European car sales as well as the industry moving more towards electric vehicles.

Sainsbury’s planned merger of Asda was thrown into doubt last week after the UK competition regulator expressed “extensive concerns” over competition within the grocery sector should the merger go ahead. The Competition and Markets Authority said the planned merger would lead to reduced competition in grocery shopping in supermarkets, grocery shopping online and petrol stations. Both Sainsbury’s and Asda have until the 30th April to respond to the regulators findings.

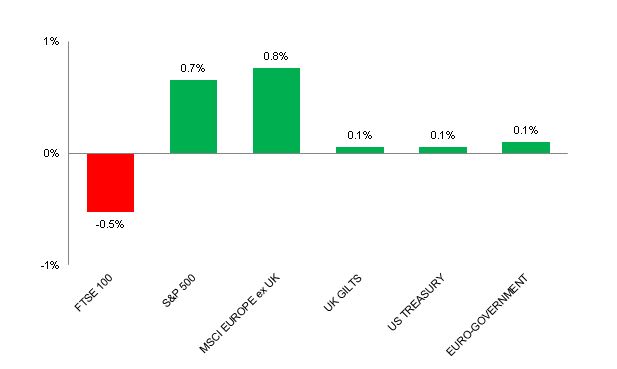

Source: Bloomberg. Figures are for the period 18th February to 22nd February 2019.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.