18th March – 24th March 2019

- Date: 18/03/2019

Front and centre of our thoughts this week include

It is likely to be another week dominated by Brexit headlines. However, Brexit aside, the highlight will be Central Bank meetings with both the US Federal Reserve (Fed) and the Bank of England (BoE) holding monetary policy meetings this week.

Fed policymakers have been keen to emphasise the need for “patience” with regards to future interest rate rises. As a consequence, no change in interest rate policy is expected at the meeting. How patient policymakers are likely to be will be reflected in the Fed’s latest “dot plots”, which show policymakers predictions for the number of interest rate rises going forward. Expectations are for the Fed to lower their projections for the number of interest rate rises expected this year to one, down from the two previously anticipated in December, when the dot plots were last updated. Investors will also be hoping that policymakers provide further details as to when the Fed intends to halt the shrinking of its balance sheet later this year.

The BoE meeting this week is also expected to yield no change in interest rate policy. BoE members have tied the fate of future interest rate rises to progress in Brexit talks, and with no resolution to negotiations in sight, it looks a near certainty that interest rates will remain on hold this week. The meeting will provide the opportunity for BoE members to provide their latest forecasts for UK economic growth, which will be interesting in light of the recent slowdown in global economic activity.

Staying with the UK, it is also a busy week with regards to economic data, with employment data for January and inflation figures for February being released. The labour market remains one of the major bright spots for the economy, with solid job creation and rising wage growth the key characteristics of the labour market of late. Inflation, on the other hand, has been on a declining trend. If these trends continue this week then it will likely provide some reassurances that the consumer can help the economy weather the political uncertainty created by Brexit.

Lastly, we also receive the preliminary March PMIs for Europe and the US, which will provide important insights into the health of the manufacturing and service sector within each respective region. Those of Europe will be of particular interest, as the improvements in the service sector confidence readings last month provided tentative signs that growth in the region may be bottoming out. If we see further improvement in the confidence surveys for Europe this week, particularly Germany’s manufacturing PMI reading, then it should reinforce this view and potentially see investors take a more optimistic outlook for the growth in the region.

Going on in the engine of Brexit

It is another pivotal week in the Brexit process, which could see the Brexit deal Theresa May has negotiated be put to parliament for a third meaningful vote. Chancellor Philip Hammond has said the Prime Minister (PM) will only put her deal to a vote if there is a strong chance that it will be approved. Winning the support of the Democratic Unionist Party (DUP) is believed to be vital to the process, with the PM resuming 11th-hour negotiations with the DUP this morning. The assumption is if the DUP offers its support for the deal, Conservative Brexiteers and even some Labour MPs may change tack and give their backing to the PM’s deal. However this is still a big “if” as it is still not clear that Conservative Eurosceptics will back her deal one way or another.

If Mrs May fails to get her deal approved this week, then it’s likely that the PM will ask for a long extension to the Article 50 process at the European Union (EU) summit on Thursday, with the EU set to decide what conditions are required to be put in place for an extension to be granted.

In the rear view mirror of last week we saw

Despite growing stronger than expected over the month in January, UK economic growth remains lacklustre. A rebound in manufacturing and construction activity saw the economy expand 0.5% over the month of January. However, the monthly data series tends to be quite volatile and investors prefer to focus on the three month change in growth to get a better perspective of the trend. The three month figures were less positive, with the economy expanding 0.2% over the three months to January, matching the sluggish pace of growth seen in the final quarter of 2018. The broader message from the growth numbers suggests that the pace of growth in the UK has shifted to a lower gear, but is stabilising at these softer levels.

As expected, the Spring Statement was a relatively low key affair. The UK Chancellor, Philip Hammond pledged to end austerity in a “deal dividend” of public spending and tax cuts if MPs can pass a Brexit deal. The Chancellor also provided the latest forecasts for UK economic growth, with the economy expected to grow 1.2% this year, down from the 1.6% forecasted in the Autumn Statement. Whilst growth is expected to dip this year, it is expected to recover in subsequent years with the forecasts somewhat optimistically predicting the UK economy will expand for the next five years.

Over in the Far East, Chinese economic data continues to present mixed messages over the health of the economy. Industrial output rose 5.3% year on year in February, which was its slowest start to the year since 2009, while the unemployment rate also edged higher. However, other data was more upbeat, and potentially showed early signs that the recent stimulus measures undertaken by the government are starting to have a positive effect, with infrastructure investment and real estate development both coming in stronger than expected.

In the side view mirrors of corporate activity we notice

Undoubtedly the biggest business story of last week was Boeing. Shares in the largest aeroplane manufacturer in the world came under pressure after the European Union, the US and China joined a long list of countries in suspending the use of its 737 MAX 8 aircraft over safety fears. The aircraft has been grounded after two recent fatal crashes in Indonesia and Ethiopia with shares in the company ending the week 10% lower.

The UK's largest outsourcing company, Interserve has been taken over by its creditors. On Friday, shareholders in the company rejected a restructuring proposal - a so-called debt-to-equity swap that would have seen existing investors stake in the company drop to 5%. As a consequence, the company went into a pre-arranged administration, with its assets transferred to a new company controlled by its lenders. The new company intends to exchange £485m of existing debt into shares in the new entity and provide £110m of additional funding for the company.

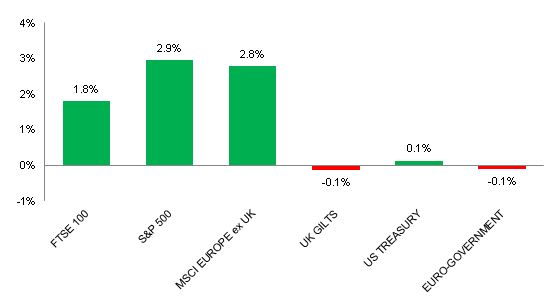

Source: Bloomberg. Figures are for the period 11th March to 15th March 2019.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.