2nd July – 8th July 2018

- Date: 02/07/2018

Front and centre of our thoughts this week include

This week marks the start of the second half of the year, if you thought the first half was volatile then we suggest you hold on tight for the next six months. Even with the upcoming summer lull in financial markets, expect the political tirade on the other side of the pond to make significant waves. Of course, we remain most concerned by economic data and what the current trajectory of global growth looks like. Early this week we will see the release of the purchasing manager indices (PMI) for June across the globe, which will provide clues on the short-term momentum for growth.

Over the weekend we saw the release of both the manufacturing and service sector PMIs in China, this after a June in which the Chinese Renminbi fell 3.3% - its worst month since China entered the FX market in 1994. Weaker manufacturing was offset by stronger service data leading to the overall composite remaining elevated. In Europe this morning we have already seen the manufacturing PMI releases. They have confirmed a stronger reading for the UK at 54.4 (expected 54.0) and a slightly weaker reading for Europe as a whole. This afternoon we will see the release of the US equivalent.

It’s a bit of a stop and start week in the US, as financial markets there close on Wednesday to observe Independence Day. They reopen again on Thursday with a slew of economic data releases which will help determine if the current trade spat coming out of Washington is starting to impair the broader economy. At the end of Thursday (7pm GMT) we will also be able to read the minutes from the Federal Reserve’s June monetary policy meeting when they raised interest rates to 2%. As we now know, the committee has upgraded its assessment on how many rate hikes it expects in 2018 to four, up from the previous estimate of three. All that before we get to another payrolls Friday, so called because we see the monthly release of the US unemployment rate (for June).

As we move into the second half of the year, the Brexit noise grows ever louder (if anyone thought was possible). This week sees Prime Minister Theresa May bring her cabinet together as they attempt to agree on what the UK’s preferred economic relationship with the EU should be, fundamentally deciding on whether it should be a soft or a hard break with the bloc. Expect some choice words from those on both sides of the Brexit spectrum, all of whom won’t be happy with the final outcome (if indeed there is one). Perhaps it is of little surprise that last week saw the EU commission come out and express concern that the UK government are yet to reach an internal agreement on what they want from Brexit. All of which doesn’t bode well for the negotiating process with the EU, especially with the UK scheduled to leave in nine months’ time.

We remain hopeful that the current heatwave, the start of Wimbledon and the knockout stages of the World Cup will be enough to keep morale high in the UK this week.

In the rear view mirror of last week we saw

Indeed there was a modest bit of good news for the UK last week, albeit not one to necessarily write home about. Economic growth in the first quarter of 2018 was revised higher from 0.1% to 0.2% by the Office for National Statistics. Sterling rose higher against the US dollar on the news. Whilst growth has been driven from higher consumer and government spending, the economy remains pegged down by weaker investment with corporates reluctant to commit capital with so much uncertainty around Brexit.

Conversely, economic growth in the first quarter of the year for the US was revised down from 2.2% to 2.0% driven by a lower contribution from consumer spending. For the past few years the Q1 GDP release has been uncharacteristically weak, reflecting seasonal factors that statisticians have been unable to account for. Despite the Q1 data appearing a little weaker, it appears a temporary phenomenon and we expect second quarter growth to rebound significantly higher.

Last week saw an intensification of the trade war that has been in the ascendency for a number of months now. Tension between the US and China is spilling over into financial markets as tariffs, currencies and now strategic technology has become a focal point. US President Donald Trump engaged in his usual approach to negotiations. He started the week aggressively by restricting Chinese investment in US tech sectors before softening his stance by Friday. Caught in the cross-fire last week was the share price of large US tech companies, which may have triggered Trump’s stand-down.

In the side view mirrors of corporate activity we notice

Tata Steel has signed a deal with ThyssenKrupp which would combine their European steel businesses in a joint venture that would create the second largest steel producer in Europe, behind ArcelorMittal. With overcapacity in the steel industry and recently introduced US steel tariffs, the deal offers the chance to generate synergies from the combined entity.

In a sign of a changing world for the grocery industry, Tesco and Carrefour will jointly purchase their own-brand products as they seek to improve deals from their suppliers and improve profitability. The deal represents a longer-term strategic alliance between the two companies as they seek to deal with the pressures from the European discount grocers, Lidl and Aldi.

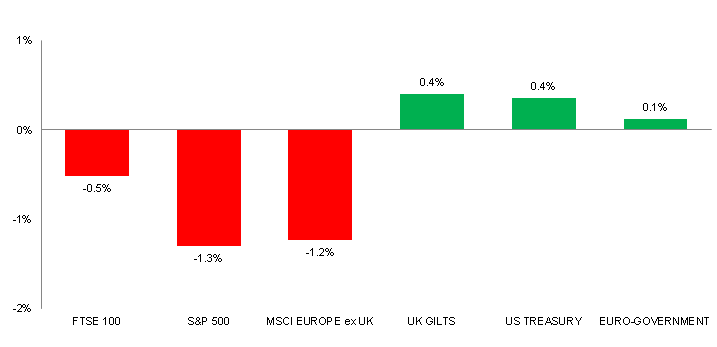

Source: Bloomberg. Figures are for the period 25th June to 29th June 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.