12th November – 18th November 2018

- Date: 12/11/2018

Front and centre of our thoughts this week include

We have written on many occasions about how inflation remains the missing ingredient in the global economic recovery. And so again this week markets will be focused on global inflation reports with central bankers hoping for some signs of life if they are to have more conviction as they tighten monetary policy. This is especially true for the US where the Federal Reserve have embarked on interest rate rises whilst inflation has been neither ‘too hot nor too cold’, implying something of a goldilocks scenario for policy makers. After a weak print in September, analysts expect the October CPI headline reading to tick back up to 2.4%.

First out of the inflation blocks this week is the UK where the release of CPI on Wednesday is expected to be higher, rising to 2.6% (year-on-year) from 2.4% last month. This month’s inflation release comes in the context of (anticipated) improving unemployment data which is released the day before. Wage growth figures had shown a significant up-tick to 3.1% in the three months to the end of August, which is the highest rate since 2009. This is important for the UK consumer because wage growth that moves above inflation results in real wage growth which has fluctuated between being negative and positive for the past few years.

At the very end of the week we will see the release of Eurozone CPI for October which is expected to rise to 2.2% (year-on-year) from 2.1%. Europe has struggled to generate significant levels of inflation in the post-crisis era and this particular data release will be watched closely by the European Central Bank. Before that the second estimate of European GDP for Q3 is released on Wednesday, where analysts expect growth to have risen from the first estimate of 0.2% to 0.4%.

Symptomatic of Europe’s sub-optimal growth is the current weakness being experienced by Germany. Tuesday sees the release of the November ZEW survey which is an indicator of economic sentiment for Germany. The survey had seen expectations for future economic conditions fall to -24.7 last month, the market will wait to see if this expectations segment has become more negative. The following day sees the flash estimate for third quarter GDP in Germany which analysts expect to turn negative for the quarter at -0.2%, down from 0.5% in Q2.

Germany are not the only country at risk of negative growth in the third quarter of the year, the third largest economy in the world – Japan – are also expected to post a minus number when they release figures on Wednesday. Both countries are large exporters, heavily reliant on them to generate growth, weak numbers here suggest that global trade wars are having a meaningful impact. It will be a busy week for Japan and Asia Pacific this week. Today US Vice-President Mike Pence visits Japanese PM Shinzo Abe to discuss the denuclearisation of North Korea while this weekend brings the Asia Pacific Economic Co-Operation Summit, hosted by Papua New Guinea.

Going on in the engine of Brexit

It feels like every week is more important that the last week when it comes to concluding the Brexit deal, perhaps that should be natural enough with the March 29th deadline ticking down on the clock. Last week’s resignation of Jo Johnson could have derailed matters, so too could have Dominic Raab’s comments over the Dover-Calais crossing but alas the negotiations continue.

However investors are now looking beyond the confirmation of any upcoming deal with Europe and assessing what chances there are of any deal being voted through parliament. With so much infighting within government, reliance by Theresa May on the DUP for votes and the opposition party providing no clear guidance on their stance, it is difficult to get too excited should a deal be confirmed this week.

In the rear view mirror of last week we saw

Last week saw the release of UK GDP for the third quarter which rose 0.6%, the fastest quarterly growth for two years. Much of the growth was driven by heightened summer activity in the UK which included a prolonged heatwave and the football world cup, indeed economic growth was actually flat for August and September. Despite this temporary reprieve for the economy, investors continue to be worried by the persistent drop in business investment which has been a feature of the UK economy since the EU referendum vote.

The most highly anticipated US mid-term election in decades came and passed as expected by financial markets and the polls. The Democrats took the House of Representatives while the Republicans took the Senate, equities rallied with the S&P500 recording its third best daily gain for the year. Many observers argue that some political gridlock would be welcome given how aggressive the current US administration has been in deepening the US deficit.

In the commodities market, the oil price continued to slide last week where the price of Brent crude has fallen from a high of $86.74 down to below $70 in the last month. This is an impressive reversal as investors assumed a collapse in Venezuelan production and new Iran sanctions would limit international supply. Tellingly, the brunt of last week’s sell-off occurred when the US administration granted waivers to their sanctions that would allow Iran to continue selling oil to their largest import markets, a group that includes China, India and Japan. Perhaps the US President’s bark is worse than his bite.

In the side view mirrors of corporate activity we notice

Corporate earnings season in the US is beginning to slow down with only a few companies left to report. Last week we pointed out that many UK retailers were reporting and overall these results were encouraging, with the persistent exception of Marks & Spencer who continue to struggle. This week sees the big US retailers report, where the recent bankruptcy of department store Sears illustrates how these companies are struggling to compete with their online peers. Look out for JCPenney and Macys results for signs of further stress.

General Electric is one company that continues to show signs of distress. Two weeks ago the company reported worse than expected earnings which lead to credit rating agencies Moody’s and Fitch downgrading the company. Last week the share price fell more than 10% as analysts issued further warnings about the level of indebtedness at the company despite the recent 92% cut in the dividend.

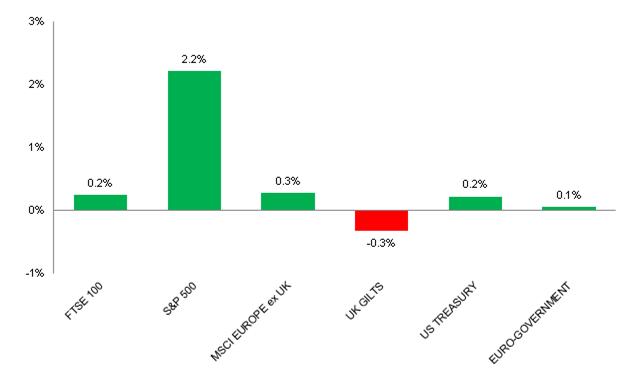

Source: Bloomberg. Figures are for the period 5th November to 9th November 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.