5th November – 11th November 2018

- Date: 05/11/2018

Front and centre of our thoughts this week include

Ever since the changing of the guard at the White House back in November of 2016, commentators have constantly speculated over whether gyrations in global equity markets have been determined by the words, and sometimes actions, of US President Donald Trump. This week brings the mid-terms, a measure of how much support he has maintained since that fateful night just under two years ago. History would tell us that the period immediately after a mid-term election is typically a bullish one for the US equity market, yet this time things do feel very much different.

We don’t attempt to forecast the outcome of political events and we will treat this week’s election just like we would any other. Given how populist some of Trump’s enacted policies have been, were we to see Congress split financial markets might find some relief. All of this takes place in the backdrop to what has been a stunningly weak October for the S&P500 where the US equity index fell the most in one month since 2011. Expect a few column inches on this one over the week.

Early in the week we will see the remainder of the October service sector PMIs released, notably the US, UK and Europe. Manufacturing PMIs have been weaker in recent months but this has struggled to materially drag down the overall composite because the service sector accounts for such a large proportion of the overall economy in developed markets. Additionally we will see Eurozone retail sales figures for September released which are expected to rise from 1.8% to 2.4% (year-on-year). In the UK the October retail sales figure is released, naturally of interest as we approach a possible deal on Brexit.

The US Federal Reserve conduct their two-day monetary policy meeting this week, although the mid-term election has forced back the meeting by a day to Thursday when we’ll hear the outcome (although there will not be a press conference). The Fed have raised rates three times already this year and are not expected to raise them at this meeting. Financial markets expect the December meeting to be the next time that they raise interest rates however October’s wobble in US equity markets has lowered the probability.

After last week’s budget presented a picture of a UK economy that was performing ahead of expectations, at the end of this week we will see the release of third quarter economic growth, or GDP. Growth has stumbled in the aftermath of the EU referendum, the first quarter figure of 0.2% this year was a low only matched by the same level of growth in the first quarter of 2017. Prior to that growth had not been as weak since the Euro crisis of 2012. Based on analyst estimates, we expect growth to have gained some momentum bouncing back to 0.5% for the quarter, higher than the 0.4% achieved in the second quarter.

Going on in the engine of Brexit

The Government successfully negotiated their way through the Budget last Monday with the Chancellor able to lift public spending and increase income tax thresholds following better forecasts for government borrowing and growth. Of course all of this was in the context of Britain achieving a suitable deal in time for March 29th of next year.

Over the weekend, news wires have suggested that the PM has secured concessions to allow Britain to stay within the customs union, over the transition period, in order to avoid a hard border in Northern Ireland. Like many stories of late, some of this needs to be taken with a pinch of salt. Reports this morning that Brexit Secretary Dominic Raab has urged the PM to ensure that Britain can pull out with three months’ notice shows that uncertainty still lingers.

In the rear view mirror of last week we saw

The Bank of England left interest rates unchanged last week but have provided a clearer forecast on the direction of monetary policy, again, assuming the Government achieves ‘some-deal’ on Brexit. Should the transition pass smoothly the BoE announced that rate rises would be gradual, suggesting that they would need to be raised to 1.5% over the next three years to keep inflation under control. In a break from previous comments the bank’s central forecast now assumes an economy that would run “hotter” which sent Sterling sharply higher.

The October unemployment report in the US last Friday was another reminder of the healthy state of the US economy, a point the US President was quick to pick up on ahead of this week’s mid-term elections. The report showed there were 250,000 job creations in the month, well ahead of economists’ estimates of 190,000, while wage growth reached 3.1% (on an annualised basis) which was the highest since April 2009. Growth is not as rosy over in mainland Europe where the release of third quarter GDP showed the Eurozone grew at 0.2% for the quarter, down from 0.4% in the last quarter.

In the side view mirrors of corporate activity we notice

The former bell-weather of the US economy, the once titan of industry, General Electric cut its dividend for the second time this year as they announced a restructuring of the business. The saving made will improve finances at the company but this has been to the detriment of the share price which has collapsed this year from over $30 in January to under $10 today.

Corporate earnings in the US slow down with 75% of companies having reported their results so far. Earnings growth continues at a brisk pace helped by tax cuts and a stronger economy however recent weakness in equity markets has been driven by a weaker outlook from many companies. Retail firms in the UK will come into sharp focus this week as a slew of high street and grocers report. Associated British Foods, owner of Primark, report tomorrow before Marks & Spencer announce half year results the following day. By the end of the week we’ll receive numbers for Sainsbury’s, who are busy steering the company through the merger with Asda.

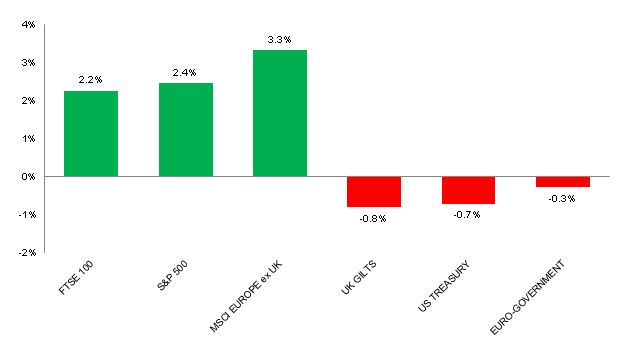

Source: Bloomberg. Figures are for the period 29th October to 2nd November 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.