4th March – 10th March 2019

- Date: 04/03/2019

Front and centre of our thoughts this week include

The focus of the market’s attention this week is likely to be the European Central Bank (ECB) meeting this Thursday. No change in monetary policy is expected but we will get a chance to see an update of the staff forecasts. These are likely to downgrade economic growth in the Eurozone. In December their growth forecasts were for 1.7% in 2019/20 and 1.5% in 2021, in contrast to the European Commission’s growth forecasts which are lower, at 1.3% and 1.6% in 2019 and 2020 respectively. We wouldn’t be surprised if the ECB moved closer in line with the Commission’s estimates by the end of this week. The overall tone in the post-meeting press conference is likely to be cautious, it is clear that economic conditions have been deteriorating more recently however the ECB still have negative deposit rates in place which limits their ability to stimulate the economy.

The National People’s Congress gets underway in China on Tuesday and runs through to March 15. This year’s focus is on the economy and we expect important policy messages to be released over the 11 days which should provide some guidance around the government’s commitment to the current GDP growth target. China’s growth rate is under pressure from two main areas. Firstly, as countries generate increased levels of economic growth, the rate of growth normally slows. It is likely that China will succumb to this as other developed economies have in the past. The second pressure is more short-term and is currently driven by the trade war tensions with the US. These are undeniably having a negative impact on export growth for China.

The first Friday of the month lends itself to huge speculation and debate in markets over the US employment report (known colloquially as Non-Farm Payrolls). February’s report is expected to remain solid, indeed so robust is the US jobs market that Federal Reserve Chair Jerome Powell cited this point in his semi-annual testimony to Congress last week. There is no doubt that that the employment market in the US is doing well, yet investors are yet to see any sign that this pent-up demand is translating into material wage growth – or at least is enough to have an impact on overall inflation. This month earnings are expected to have risen 0.3%, pushing the annual rate up to 3.3%.

There are a few other important bits of economic data that are worth keeping an eye out for over the week. The release of Italian GDP tomorrow will be important ahead of the ECB meeting who have to contend with a populist coalition government in Italy who appear intent on playing by their own rules. Of most significance will be the monthly global Purchasing Manager Indices where we will get a read-through of how businesses view their respective underlying economies.

From a domestic perspective the UK appears to be going through an extremely sticky patch, only four weeks away from Brexit. This morning we have seen the UK Construction PMI released which has fallen below the crucial 50-mark which is indicative of a contractionary environment for the construction industry. Tomorrow sees the release of the UK Services PMI where economists are forecasting a figure below the 50-mark, given this is the dominant sector within the economy we nervously await the release.

Going on in the engine of Brexit

Last week was relatively uneventful, negotiations on the Irish backstop continue on the sidelines yet neither side appear to have found a compromise. The series of parliamentary votes last Wednesday were something of a non-event because the Government had already conceded on the main points. The Labour Party did eventually declare their new Brexit policy, after their previous plan to remain as permanent members of the European Customs Union failed in a parliamentary vote. Late last Wednesday, party leader Jeremy Corbyn declared that Labour would back another public vote on membership of the EU. Sceptics suggest this was to placate members of his party after some broke away to form the Independent Group in the last few weeks.

Weekend reports suggest that the hardline Brexit faction within the Conservatives (known as the ERG) may support the Withdrawal Agreement so long as Theresa May names her departure date as UK Prime Minister. It is unlikely that such an offer will be on the table ahead of the next meaningful vote that has been earmarked for March 12, 13 and 14 – not least because she survived a vote of no-confidence last December and has another year before she can be challenged again.

In the rear view mirror of last week we saw

The Hanoi summit of US President Donald Trump and North Korea leader Kim Jong-un failed to result in a denuclearisation plan that had been initially drafted in Singapore in June last year. On the same day Trump’s former personal lawyer testified before Congress in what turned out to be a fairly damaging day for the self-proclaimed ‘deal-maker’.

Economic data last week was broadly in line with expectations. Monthly consumer confidence data in the US ticked up again after a brief period of weakness, while Q4 GDP was better than expectations at 2.6% but below the 3.4% figure recorded in Q3. Inflation data in the Eurozone also showed a slight tick upward from the previous month with France, Italy and Spain all experiencing higher inflation in February.

In the side view mirrors of corporate activity we notice

Car-booking app Lyft will beat its more famous competitor Uber to an IPO this year as documents released last week detailed the firm’s revenue generation over the past three years. The recent trend has been for larger tech companies to put off publically listing their equity stakes as they had been largely able to finance themselves through private equity.

A fortnight after cake maker Patisserie Valerie was rescued by private equity firm, Causeway Capital, changes have been made at management level to redirect the company. The business was delisted on February 25with the firm’s former finance director and former auditor, Grant Thornton under investigation.

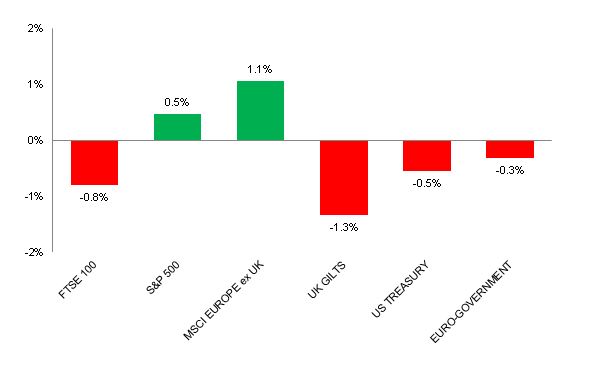

Source: Bloomberg. Figures are for the period 25th February to 1st March 2019.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.