4th June – 10th June 2018

- Date: 04/06/2018

Front and centre of our thoughts this week include

This week is a much quieter one in terms of economic data. However, as we ended last week with heightened geopolitical tensions surrounding tariff wars and the Italian political situation, economic data would have probably taken a backseat this week regardless.

Having said that, we have kicked off the week in positive fashion, with the UK’s May Construction PMI (indicator of health of the sector) coming out ahead of expectations. Tomorrow we will also get the UK’s May Services PMI. April’s reading ticked up marginally from March, but this followed a sharp fall the previous month, indicating UK economic growth has lost some momentum. The Bank of England (BoE) felt confident that first-quarter economic data was hindered by poor weather, a view that differs from the Office for National Statistics (ONS). The Met Office confirmed that last month was the hottest May in the UK since records began, so there is one less excuse if the reading disappoints. The consensus is for the PMI to increase to 53.5.

We also receive the Euro area’s final Services PMI for May tomorrow. Although the final reading is expected to be 53.9, indicating healthy expansion in the services sector, it has fallen over the past few months after peaking at 58.0 in January. We also see the final estimate for Euro area first-quarter GDP growth on Thursday. Despite some disappointing data in the first-quarter, GDP growth is expected to remain unchanged at an impressive 2.5%.

Wrapping up some of the economic data we will be keeping an eye on this week, we will be paying attention to the final estimate of first-quarter GDP growth for Japan, released early Friday morning. The latest estimate indicated a contraction in the economy (-0.2%) for the first time in two years.

After another whirlwind week for Italian politics, which ended in law professor Giuseppe Conte being sworn in as Italy’s prime minister, the new anti-establishment government face their final hurdle before they can kick-on – a confidence vote in both houses of parliament. This is expected to happen early this week. Whether it calms or excites markets is hard to predict.

In the rear view mirror of last week we saw

As we have discussed for much of this year, economic data in 2018 has been, on the whole, disappointing relative to expectations. However, recent data has broken this trend and surprised positively. Unfortunately, the geopolitical world didn’t get the memo, with the market being spooked by the ‘up in the air’ Italian political situation, as well as US President Donald Trump announcing they would be imposing tariffs on trading allies Canada, Mexico and the EU.

Starting off with economic data in the US, the big news came on Friday in the latest monthly employment report. The report garnered a significant amount of attention – not because of the strength of it, but because President Trump broke protocol and controversially tweeted about the report around an hour before it was released. The President was briefed on the data the day prior, with his tweet resulting in a shift in markets as traders speculated a strong report. Indeed, the unemployment rate unexpectedly fell to its lowest in 18 years (3.8%), in tandem with annual earnings growing more than expected (2.7%). As a result, this has left the market expecting the Federal Reserve (Fed) to hike interest rates at their next meeting on 13th June.

Euro area data for the week was also broadly positive. Inflation managed to pick up in May, with headline inflation seemingly hovering around the European Central Bank’s target of just below 2.0%, while core inflation also jumped up ahead of expectations to 1.1%. Finalised Manufacturing PMIs for May also came out broadly in line.

The main piece of data from the UK continued this positive trend from last week, which was the latest look at the health of the manufacturing sector (PMI) – the index unexpectedly rose, further indicating that the economy is rebounding from the weak first-quarter.

With the amount of political and economic news rumbling on last week, a story that could have easily slipped under the radar was the easing of financial regulation in the US. More specifically, regulators unveiled changes to ease the Volcker Rule. The Volcker Rule came about following the 2007/08 financial crisis, and essentially prevents banks from making certain types of speculative investments. This marks Federal Reserve chair Jay Powell’s first movement in reducing regulatory burdens in the US financial system – we will be watching closely to see if this continues considering the likely positive reaction it will have on US financials and trying to understand the accompanying increase in financial risk.

In the side view mirrors of corporate activity we notice

Last week marked the latest reshuffle of the blue-chip FTSE 100 index. Despite worries about Marks & Spencer dropping out, their share price managed to remain high enough to hold onto their FTSE 100 tag, something they have done since the index began in 1984. With the 134-year-old veteran struggling, it was their ‘new economy’ counterpart, Ocado, which was one of the new additions.

Deutsche Bank continues to face further challenges, as their US subsidiary was now on the Federal Deposit Insurance Corporation’s list of “problem banks”, indicating it faces serious challenges to its survival. This occurred on Thursday, before rating agency Standard & Poor added salt to the wound on Friday by downgrading Deutsche and its core subsidiaries.

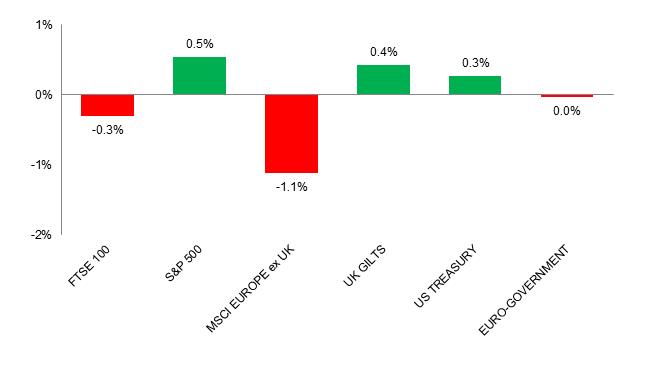

Source: Bloomberg. Figures are for the period 28th May to 3rd June 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.