4th February - 10th February 2019

- Date: 04/02/2019

Front and centre of our thoughts this week include

In what is a relatively quiet week in terms of economic data, arguably the highlight will be the Bank of England (BoE) meeting on Thursday, updating us on their first interest rate decision of 2019. Not only does the unknown Brexit outlook indicate that the BoE’s Monetary Policy Committee (MPC) are unlikely to make any changes to interest rates, but inflation has also fallen to levels around their target of 2% – largely due to sterling’s sharp devaluation in the aftermath of the EU referendum now fallen out of the year-on-year calculations. Add to this the struggling manufacturing and housing data any hike is unlikely.

On Wednesday, the day prior to the central bank meeting, we receive the latest insight into the health of the service sector (in the form of the PMI), which is of high significance considering the UK economy is largely driven by the service sector. Current forecasts are for January’s PMI reading to fall to 51.0, significantly below the three year average of 53.5 and teetering close to contractionary territory (i.e. below 50).

Now that the US government has been reopened, Nancy Pelosi (House speaker) has allowed President Donald Trump to deliver his State of the Union address, which was originally pencilled in for 29th January. The President will be speaking tomorrow, where the topic will cover legislative priorities going forward. As such, you would expect it to be dominated by immigration and border security, with plenty of references to this apparent ‘caravan’ marching towards the country.

This quarter’s US earnings season is nearing an end, where companies have been reporting on fourth-quarter trading. As of 1st February, 234 companies in the S&P 500 had reported, with 71% beating analysts’ earnings expectations – yet again another strong quarter for US earnings. This week we have Twitter and, more importantly, Alphabet (Google’s parent) providing updates. From the UK, BP and GlaxoSmithKline’s updates will be in focus.

Going on in the engine of Brexit

Last week sterling came under pressure as MPs voted to send Prime Minister Theresa May back over to Brussels with the tough task of attempting to renegotiate the withdrawal agreement. Unsurprisingly, the EU was quick to reject the prospect of this happening, with European Council President Donald Tusk confirming the deal is “not open for renegotiation” shortly after Parliament voted.

Considering Mrs. May’s current stalemate-scenario, where she requires a Parliamentary majority to pass the divorce bill, and the seemingly only deal that would garner a majority in Parliament looks highly unlikely to be agreed to by the EU, the risk of a ‘no deal’ must surely be increasing.

The result is continued opacity. It’s this opacity that has seen corporations, understandably, alter their strategic plans to protect themselves. Nissan is the latest high-profile example, as they confirmed last week that their new model, the X-Trail, will be produced in Japan as opposed to Sunderland where they originally planned.

In the rear view mirror of last week we saw

It was a strong week for equities last week following a very dovish Federal Open Market Committee (FOMC) meeting on Wednesday. It was a substantial change in direction by the Federal Reserve (Fed), where they emphasised their need to be “patient” in determining the future path of US interest rates. This falls in stark contrast to their previous meetings, in which they continued to inform the market of “further gradual” hikes in interest rates. It was the first time the S&P 500 rose on the FOMC announcement day since Jay Powell took the helm, indicating this sharp shift in stance to a more dovish outlook.

A widely held view is that central banks tightening monetary policy too sharply have historically been a catalyst for causing recessions; this change in stance by the Fed should go some way to alleviate fears of an impending US recession – for now at least.

The strength of the US employment report on Friday should also ease investor fears, with the economy adding 304,000 jobs during January, far exceeding forecasts of 165,000. It is worth noting that December’s reading was revised down by 90,000, however the broader trend is certainly one of strength. The unemployment rate did move up to 4.0%, however the reading was muddied by the fact the 380,000 not paid due to the partial government shutdown were considered temporarily unemployed.

While the US economy looks to remain on a steady footing for the moment, the Eurozone looks to be faltering. Last week it was confirmed that Italy is now in technical recession following two consecutive quarters of negative GDP growth.

In the side view mirrors of corporate activity we notice

General Electric is showing signs of a much-needed recovery. New chief executive, Larry Culp, announced strong revenue growth as well as the extent of the agreed settlement with the Department of Justice with regards to their role in the subprime mortgage crisis. The agreed settlement is a hefty $1.5 billion, which has been agreed in principle, however this is towards the lower end of analyst fears and as such the shares rallied in what was the largest intraday gain for the shares since 2009.

Facebook also provided their trading update, announcing that their earnings in the fourth quarter of 2018 topped analysts’ expectations. The strong results should calm fears over recent scandals, which proved to be the case as the shares rose over 10% on the day.

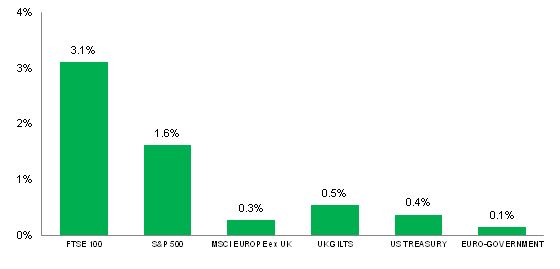

Source: Bloomberg. Figures are for the period 28th January to 1st February 2019.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.