30th April - 6th May 2018

- Date: 30/04/2018

Front and centre of our thoughts this week include

It is another action-packed week in financial markets. Starting in the US, on Monday we receive the US Federal Reserve’s (Fed) preferred inflation measure, Core PCE. This is expected to rise to an annualised rate of 2%, a level not seen since April 2012, and a reading which will add to a growing list of indicators which show inflationary pressures are building within the US economy. The Fed also holds a monetary policy meeting on Wednesday, although it is expected to be a quiet affair, with no change in interest rates expected. There will also be no press conference from Fed Chair Jerome Powell after the meeting so investors will be paying close attention to the meeting’s accompanying statement for any changes in tone or language describing growth or inflation in order to assess the Fed’s latest views on the economy. The most significant economic data released this week from the US comes on Friday, the employment report, commonly known as Non-farm payrolls. The report is expected to show the US economy created 195k jobs in April, a pick-up from the 103k created in the previous month. The most closely watched aspect of the report will be the average hourly wage growth figures, as these will provide a useful insight into the cost pressures faced by firms and ultimately the level of inflationary pressures within the economy.

In the UK, the construction, manufacturing and service sector PMI sentiment reading this week have gained in significance given the weakness in the first quarter GDP growth numbers (more below) seen last week. These sentiment surveys will provide a useful guide into the state and direction of the UK economy. Inclement weather had a negative impact on both the construction and service sector sentiment readings in March, and a rebound in April’s figures is expected for both. If we do see a rebound, it may provide some assurances that the slowdown in economic activity since the start of the year may prove temporary.

Over in Europe, we receive first quarter GDP growth numbers, which are expected to confirm that the economy lost some momentum since the start of the year, with quarterly growth expected to be 0.4%, down from 0.6%, recorded in the last quarter of 2017. We also receive CPI inflation numbers for April, which are expected to show that inflationary pressures within the region remain subdued, a result which could see the European Central Bank delay the date that it ends its Quantitative Easing Programme.

Lastly, on the corporate front, 147 S&P 500 companies are set to report first quarter earnings results this week, including Apple, McDonalds and Tesla. Apple’s results in particular are set to be closely scrutinised and could have wider implications for the technology sector on the whole, as investors remain concerned that the company will report a weak set of results due to disappointing sales of the iPhone 8 and iPhone X.

In the rear view mirror of last week we saw

In recent years, seasonality effects have traditionally seen the first quarter GDP growth numbers in the US disappoint. This year’s numbers followed the tradition with the US economy growing at a slower annualised rate of 2.3% in the first quarter of 2018, down from the 2.9% seen in the fourth quarter of 2017. However, the figures were marginally better than the 2% rate predicted by economists.

In the UK, first quarter GDP growth numbers were weaker-than-expected and significantly lower the chances of the Bank of England (BoE) raising interest rates again in May. The UK economy grew 0.1% in the first quarter of the year, below the 0.3% forecasted, and the slowest rate of quarterly growth since 2012. The "Beast from the East" has been blamed for the slowdown, with the weather sensitive construction and retail sectors seeing the largest slowdown in growth. The weak growth numbers add to a string of disappointing data from the UK of late and the BoE will likely want to see evidence of a pick-up in economic activity before raising rates again.

Lastly, there was some positive news on the geopolitical front, with North Korean leader, Kim Jong Un, meeting his South Korean counterpart, Moon Jae-in. In doing so, he became the first North Korean leader to set foot in South Korea since the 1950’s. At the extraordinary meeting, both leaders agreed to completely cease all hostile acts against each other and work towards denuclearising the Korean peninsula.

In the side view mirrors of corporate activity we notice

Over the weekend it was announced that Sainbury’s has agreed to merge with rival Asda. Under the terms of the deal, Asda’s owner Walmart will retain a 42% stake in the newly-merged company. The deal is likely to be closely scrutinised by the Competition and Markets Authority (CMA), but if approved, the combined supermarket will have a 31% share of the grocery sector, overtaking current leader Tesco, on 28%. Sainbury’s shares surge by over 15% and Tesco’s declined after the announcement.

After pressure from a number of activist investors, Whitbread announced that it will separate its Costa Coffee business, from its remaining business interests, including hotel chain Premier Inn, via the demerger of Costa. Under the plans Costa will become an independent company with its own stock market listing within the next two years. Investors had been seeking the demerger on the grounds that the separated firms would be valued more highly apart than combined.

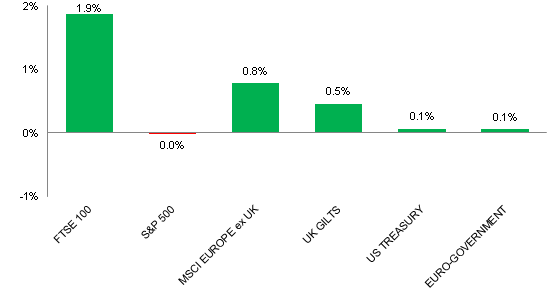

Source: Bloomberg. Figures are for the period 23rd April to 29th April 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.