21st May – 27th May 2018

- Date: 21/05/2018

Front and centre of our thoughts this week include

It’s another quiet week in regard to economic data releases with the highlight being the release of the preliminary manufacturing and service sentiment surveys for Europe and the US as well as the manufacturing survey for Japan. These indicators are reasonable predictors of future rates of economic growth and will therefore help set expectations for the underlying growth momentum within each economy. Both the European and US indicators are expected to decline slightly but remain at levels that imply growth remains stable.

In the UK we see a number of data releases which will provide clues over the timing of the next interest rate rise from the Bank of England (BoE). The BoE delayed raising interest rates in May as economic data over the first quarter of the year came in weaker-than-expected. Consumer spending in particular was weak and the release of retail sales figures for April will show whether this trend persisted. Expectations are for retail sales to rebound which should provide the BoE with some confidence that the weakness in growth over the first quarter will prove temporary.

We also receive the Consumer Price Index (CPI) for April - inflation has been on a declining trend since reaching a peak of 3.1% in November 2017, which eased the pressure on the BoE to raise rates. Expectations are for annual CPI in April to remain at 2.5%, a lower reading could take further pressure off the BoE, at least in the short term. Additionally, we also receive the second estimate of first quarter economic growth, which is expected to confirm growth was weak in the first quarter of the year at 0.1% quarter on quarter (qoq), in-line with the first estimate.

In the US, the focal point will be the release of the minutes from the Federal Reserve’s (Fed) monetary policy meeting earlier this month, which should provide some further insight into policymakers’ views on inflation and growth. With that said, since the meeting, both wage growth and CPI numbers have been lower than expected, which may make discussion on economic data from the meeting a little outdated. As a consequence, speeches from various Fed committee members this week, in particular Fed Governor Jerome Powell’s speech on Friday will likely gain more attention from investors. Additionally, we also receive existing and new home sales for April - according to Bankrate, 30 year mortgage rates are up 0.70% since the start of the year, so it will be interesting to see if this has had any negative impact on home sales.

In a quiet week for economic data, political developments are also likely to dominate headlines, particularly with respect to Italy. The Five Star Movement (5SM) and Lega progression in forming a coalition government has increased the level of political risk in Italy, particularly as both parties are interested in relaxing fiscal policy (government spending and taxes) – a result which will raise tensions between Italy and European institutions and raise question marks over the country’s commitment to the European Union.

In the rear view mirror of last week we saw

After weeks of disappointing economic data in the UK, last week’s data bucked the trend and finally brought some much needed cheer. The UK employment report for March showed employment rose by 197,000 in the three months to March, stronger than the consensus estimate of 130,000. The most pleasing aspect of the report, however, was the increase in wages, which rose at an annual rate of 2.9% (excluding bonuses) in the three months to March, higher than the rate of inflation (2.7%) over the same period. With wages trending higher and inflation lower, there is a growing expectation that UK households are likely to experience a sustained rise in real wages (inflation adjusted) going forward, an outcome which should be positive for consumption, growth, and household budgets. Meanwhile, the report showed the unemployment rate held steady at 4.2%, its lowest rate since 1975.

It was a similarly positive week for economic data out of the US, with data on the whole suggesting that a rebound in economic activity is likely over the second quarter. In April, industrial production rose at a stronger than expected rate. Meanwhile, retail sales for April printed in-line with expectations but this came after the estimates for the previous two months were revised higher – a potential sign that households are starting to spend some of their windfall from Trump’s tax cuts earlier in the year.

Trade tensions between the US and China also de-escalated, after the two countries issued a joint statement over the weekend on the progress of negotiations. China has announced they will “significantly increase purchases of United States goods and services” to try and reduce its trade surplus with the US. Both countries also announced they would delay imposing trade tariffs on one another while talks are on-going, a result which lowers the risk of a trade war.

The positive news did not extend to Japan with preliminary estimates of economic growth over the first quarter of 2018 showing the economy shrank by 0.1% qoq. This marked the first decline in growth since 2015 and ended the economy’s longest successive period of economic growth since the 1980s. Perhaps the most disappointing aspect of the report was the fact that estimates of growth over the fourth quarter of 2017 were also revised down from 0.4% qoq to 0.1% qoq, suggesting the underlying trend in growth is weaker than expected. The result of which will likely mean the Bank of Japan is in no rush to reduce its monetary stimulus this year.

In the side view mirrors of corporate activity we notice

It was a rollercoaster week for UK bookmakers. The news that the US Supreme Court declared the Federal Law (PASPA) which essentially limits sports betting to Nevada, unconstitutional caused a surge in their share prices – as analysts expect UK bookmakers to be well placed to grab a slice of the estimated $150bn in illegal bets made in the US each year, once states draw up their own gambling laws. However, their mood was dampened by the news that the UK government plans to reduce the maximum stake on fixed-odds betting terminals from £100 to £2. The change requires parliamentary approval but is expected to come into effect next year. In the end, the PASPA ruling had a bigger impact on revenue expectations with all internationally focused bookmakers ending the week higher.

Shares in Ocado, the online supermarket and logistics company, surged last week on the announcement that it reached an exclusive deal with US grocery giant, Kroger. Under the terms of the deal, Kroger will take a 5% stake in Ocado and have exclusive access to its logistics technology in the US. In the UK, Ocado uses automated systems and robots to process and package online grocery orders in distribution centres, and under the terms of the agreement, plans to open three automated distribution centres in the US this year and up to twenty over the next three years. It is hoped the deal will revolutionise on-line grocery sales in the US which currently account for 1.5% of total grocery sales, markedly below the 7% rate in the UK.

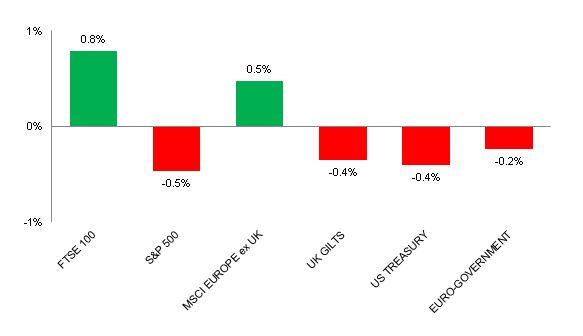

Source: Bloomberg. Figures are for the period 14th to 20th May 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.