1st April – 7th April 2019

- Date: 01/04/2019

Front and centre of our thoughts this week include

Welcome to April Fools’ Day where, at least in the recent past, truth has felt stranger than fiction. After an incredibly strong first quarter of 2019 for asset prices, we also wish a warm welcome to Q2 where markets have already got off to a strong start. Statistics show that Q4 of 2018 was the worst quarter for equity markets in seven years, fast forward to the next quarter to Q1 of 2019 and we arrive at what was the best quarter for equity markets in seven years. To describe this part of the economic cycle as volatile would be an understatement. It also shows the huge importance of looking through the short-term noise in markets as part of the investment decision-making process. Now back to our regular scheduling.

The start of a new month brings a slew of April PMI data which helps to understand the short-term views of business, both manufacturing and non-manufacturing. Over the weekend we saw the release in China which was far stronger than expected, this after a period in which Chinese data had begun to materially weaken. The forward-looking sub components of both the manufacturing and non-manufacturing indices rose to their highest levels in six months, a sign that some of the fiscal stimulus from earlier in the year is starting to have a positive impact.

This, in turn, should be positive for the European economy where trade linkages with China and Asia are so vital. This morning’s manufacturing PMI data out of Europe suggests that there is still a lagged effect, as data from Germany, France and Italy have all shown a deterioration which has dragged down the overall European number and remains in recessionary territory. In brighter news for the UK economy, the manufacturing PMI data has hugely surpassed expectations, rising from 52.0 to 55.1 – the highest since February 2018. Evidence suggests that businesses are stock-piling in advance of Brexit leading to an increase in activity for manufacturers.

The first Friday of the month lends itself to speculation and debate in markets over the US employment report (known colloquially as Non-Farm Payrolls). February’s report was in fact rather soft (20,000 jobs created) after a blockbuster January where over 300,000 jobs had been created in the month. This data series can be volatile and the quarterly number continues to show robust growth in the US labour market. At this stage of the economic cycle, investors are principally focused on wage growth which provides insight into the overall health of the US consumer. Forecasters expect average hourly earnings to rise 0.3% in March with the unemployment rate holding steady at 3.8%.

Finally, keep an eye out for further news around the China-US trade talks which are expected to dial up a notch as Chinese Vice Premier Liu He visits Washington this week for further discussions. Helping to soothe relations has been the news over the weekend that the Chinese government will continue to extend the suspension of retaliatory tariffs on US cars. With President Trump having already delayed tariffs from their original March 1st deadline, it appears as though both sides are serious about reaching a compromise. Whether they are able to do this in a timely enough manner with the clock running down to the last year of his current term as US President, we will have to wait and see.

Going on in the engine of Brexit

We began this section last year with the intention of withdrawing it once Britain had exited the European Union, after all politics does not drive our investment process. Well, here we are, our supposed first business day in the new post-Brexit world, and yet there doesn’t appear to be any light at the end of the tunnel. Maybe the UK Government are playing an April Fools’ Day trick on the electorate after all?

As ferries continue to depart Dover and the supermarkets remain fully stocked with baked beans, we can reflect on what was truly a momentous week in British politics. Whether the tired and disparate electorate feel that last week was anything to be momentously proud of -remains to be seen. What is clear is that MPs are struggling to find any sort of conclusion to the Brexit fiasco.

Today sees Commons Speaker John Bercow announce motions related to the indicative votes that were originally debated and voted on last Wednesday. It is expected that the two alternative options which garnered the least amount of resistance last week will be put forward with voting taking place after the debate that begins at 8pm tonight. Weekend news has thrown out the odd story of a potential general election but that idea has been thrown around before.

For now April 12th remains the current date of Britain’s exit from the European Union, however I suspect there’s a good chance we’ll be updating you on the back and forth of this political merry-go-round for a little longer yet.

In the rear view mirror of last week we saw

Growth in the US economy for the fourth quarter of last year (as measured by GDP) was revised lower again. According to the official third estimate, the world’s largest economy expanded at an annualised rate of 2.2% down from the previous forecast of 3.0%. This was after a strong Q3 reading in the US where growth reached 3.4%. It appears as though the US economy is settling back into a more normalised rate of economic growth after the effects of the tax cuts in early 2018 start to wear off.

As noted, last week saw out the end of what has been an exceptionally strong quarter for most assets with both equities and bonds generating robust returns. This outcome throws up more questions than answers and one which investors will be trying hard to reconcile. If risk assets like equities are doing well, shouldn’t defensive assets like fixed income perform poorly? It would suggest to us that central banks are doing too much to support the global economy at a time when it possibly doesn’t need as much help.

In the side view mirrors of corporate activity we notice

This morning low-cost carrier EasyJet has warned of pre-tax losses in the first half of 2019 from higher costs and Brexit uncertainty driving down demand. Some of the higher costs had been expected as higher fuel bills and new investment in planes would come through. Of more worry is the blame for waning demand on an uncertain macro environment which has impacted revenue per seat.

Last week saw department high street chain Debenhams almost fall by the wayside as the Amazon effect ripples through the industry. In searching for £200mn of financing, Sports Direct, owned by Mike Ashley, considered the £6.4bn takeover which lifted the share price. In the end the company were able to secure the financing from the majority of its current bond holders.

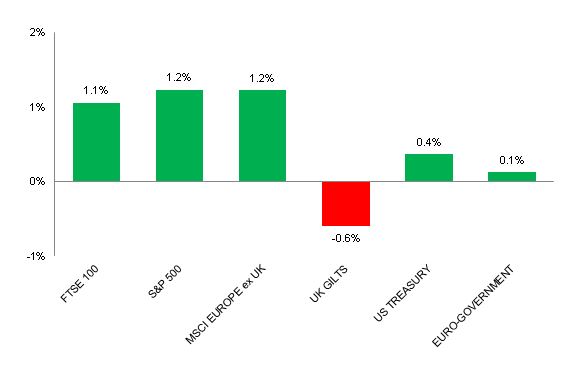

Source: Bloomberg. Figures are for the period 25th March to 29th March 2019.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.