15th October – 21st October 2018

- Date: 15/10/2018

Front and centre of our thoughts this week include

After a couple of weeks of suffering, investors will be hoping this week can instil some confidence back into markets. One aspect that could restore some confidence is in US corporate earnings released this week as we enter the latest quarterly earnings season. According to Thomson Reuters, consensus is for third-quarter earnings to grow 21.5% compared to last year’s third-quarter.

Staying with the US, we will also get the Federal Open Market Committee’s (FOMC) minutes from their meeting in September where they raised interest rates by another 0.25%. The latest minutes should add some colour around the FOMC member’s views about growth, inflation and the future path of US interest rates. Bearing in mind the two financial market sell-offs in 2018 (the first at the end of January) were triggered largely due to concerns that the Federal Reserve (Fed) may have to increase interest rates faster than expected, these minutes could prove to be significant for the shorter-term direction of markets.

From the UK we receive some key economic data: August employment report, September inflation report and September retail sales. In terms of the employment report, the market expects no change from July’s levels, including an unemployment rate of 4.0%. With inflation overshooting expectations in August, we will be hoping for strong wage growth tomorrow to ease fears over the weak real wage growth UK consumers have been experiencing.

Shifting over to the main political stories to follow this week – it’s mainly focused around the European Union (EU) in the form of Brexit negotiations (more on that below) and the Italian budget proposal to the European Commission today. As has been widely documented, Rome initially proposed running a larger budget deficit than anticipated, which resulted in a sell-off in Italian assets and damaged investor sentiment surrounding the EU. However unlikely it is, we will be hoping they have made some last-minute changes towards a less aggressive budget.

Finally, geopolitical tension as a result of the disappearance of Saudi journalist Jamal Khashoggi has seemingly risen, with US President Donald Trump weighing in. In Mr Trump’s interview with CBS News over the weekend he stated that Saudi Arabia will face “severe punishment” if the regime murdered Mr Khashoggi. Although the price of oil has remained relatively stable, we believe there’s good chance both the volatility and the level of the oil price will increase – the longer questions remain unanswered, the likelihood of repercussions from Mr Trump (and across the globe) in the form of sanctions undoubtedly increases.

Going on in the engine of Brexit

Just as it seemed like both sides were inching closer to a deal last week, this morning it feels like we are back to square one. Brexit secretary, Dominic Raab, returned from a meeting with Michel Barnier, the EU chief negotiator, which supposedly lasted just one hour after Mr Raab made clear Theresa May could not agree to the current terms – the main sticking point remains to be the issue of the Irish border. This recurring issue seems to be an impossible task – although that hasn’t stopped the Swiss being able to complete it.

Last week there was, however, some positive news for Mrs May as it was reported that a group of Labour MPs, up to 30 of them, are considering going against Jeremy Corbyn and voting in favour of Mrs May’s Brexit deal. Mr Corbyn is expecting his MPs to vote against whatever deal the Prime Minister achieves, however the 30 Labour MPs fear the economic consequences of the UK leaving the EU with no agreement at all.

We expect this week to be dominated by Brexit news as we have tomorrow’s cabinet meeting devoted to Brexit before EU leaders meet on Wednesday to discuss their withdrawal agreement.

In the rear view mirror of last week we saw

Outside of concerns about the severity of the latest sell-off in financial markets, the UK economy also came under the spotlight. Wednesday we received the latest estimate of monthly GDP growth for August, which disappointed slightly as the economy remained flat with growth of 0.0% for the month. This was, however, offset as July’s reading was revised upwards. Overall, this is pointing to a relatively strong third-quarter of GDP growth for the UK, although we shouldn’t forget the one-off positive impact the sunny weather and World Cup had on economic growth in July.

Of course, the outlook for the UK economy is going to be largely reliant on the outcome of Brexit negotiations. The International Monetary Fund (IMF) had their say on this last week, putting further pressure on Philip Hammond, Chancellor of the Exchequer, by urging the UK to lift public spending to help soften the blow on economic growth. It’s an important point, and one that should not come as a surprise seeing as the UK is relatively limited to stimulate growth by monetary policy as interest rates remain near record-low levels. However, the following day the IMF updated a report on the strength of countries public finances where the UK was lagging around the bottom of the pile. If Philip Hammond does end up having to loosen the UK’s purse strings, this could well present issues surrounding public debt levels further down the line.

Following the severe market environment over the past couple of weeks, the US CPI (inflation) reading on Thursday was the focus of our attention. Although it isn’t the Fed’s preferred inflation metric, we were worried a higher-than-expected reading could add fuel to the fire as markets worry interest rates in the US could rise higher than anticipated, resulting in substantial complications for asset valuations. In the end, CPI was actually a touch weaker than expected as the annualised headline CPI figure for September dropped down to 2.3%, from 2.7% a month earlier. The corresponding, less volatile core CPI figure remained unchanged at 2.2%.

Elsewhere, we received the European Central Bank’s (ECB) minutes from their September meeting. There was nothing contentious; however, it did show discussions about the potential impact from trade tensions on the growth outlook – the ECB seem to be increasingly concerned about such risks. In terms of guidance on ending quantitative easing (QE), the target remains to end it by the end of the year.

In the side view mirrors of corporate activity we notice

It was announced on Wednesday that Aim-listed café chain, Patisserie Valerie, had been subject to accounting fraud, with the company’s shares being suspended while the irregularities are being investigated. At present, the situation is looking dire with its Finance Director, Chris Marsh, being arrested on Friday and the company requiring an immediate cash injection to continue trading. Luke Johnson, the company’s chairman and largest shareholder, has committed up to £20 million to keeping Patisserie Valerie afloat.

US third-quarter corporate earnings season kicked off towards the end of last week. As usual, it was the banks that reported first, including Citi, JP Morgan and Wells Fargo. All three reported large increases in quarterly profits with JPMorgan, America’s largest bank by assets, reporting a 24% increase in earnings for the third-quarter compared to the third-quarter in 2017. On the face of it this looks very promising, but it has to be put into context. With the tax cuts passed in the US, the average tax rate of the above three banks was 22%, which compares to 31% a year ago.

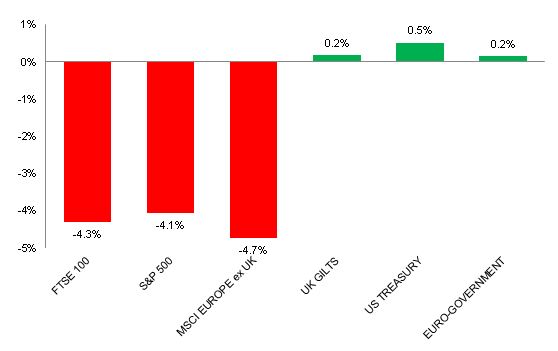

Source: Bloomberg. Figures are for the period 8th October to 12th October 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.