14th May – 20th May 2018

- Date: 14/05/2018

Front and centre of our thoughts this week include

In terms of economic data releases, it’s a relatively quiet week. With nothing of note being released today, we will be waiting until Tuesday morning when we get the UK’s latest employment report. With UK consumers continuing to battle higher levels of inflation and the negative impact this has had on their spending power, our attention will be focused on wage growth in the report. We also see the unemployment rate, which is expected to hold steady at 4.2%.

Later on Tuesday will be the release of retail sales for the US. With consumer expenditure making up around two-thirds of GDP, this is always closely watched. It will also be the latest opportunity for us to see how far US consumers have loosened their purse strings after the strong employment report, in which unemployment dropped lower than forecast (to 3.9%), and the “Trump-bump” to wages following the tax reforms.

We receive the first estimate of first-quarter Japan GDP growth on Wednesday, where it’s expected to contract for the first time in two years due to disappointing exports and consumer spending. If this does indeed materialise, it would end their longest period of expansion since the 1980s. Despite Shinzo Abe’s (Prime Minister) best efforts to date, the structural issues within the economy, most notably demographics, undoubtedly continue to weigh.

Away from the data, expect some newsflow around a potential conclusion to Italy’s general election back in March. It’s looking increasingly likely that the anti-establishment Five Star Movement will form a coalition with the far-right League party, with discussions close to reaching an agreement over the weekend. This result would undoubtedly be investors’ worst-case scenario, as the anti-EU parties would add to further uncertainty surrounding the future of the bloc, or perhaps Italy’s membership within it. The leaders from the two parties are expected to meet the head of state today, as they work on agreeing the next Premier of the new government.

Expect to hear further geopolitical news outside of Italy this week too, as stories rumble on. North Korea has pledged to dismantle their nuclear site, which is expected to be done later this month. The favourite to win this year’s Nobel Peace Prize, US President Donald Trump, has labelled the pledge a “very smart and gracious gesture”. Discussions surrounding Brexit talks will also dominate newsflow, with Prime Minister Theresa May writing in the Sunday Times over the weekend calling for unity over Brexit. Mrs May is also expected to outline her proposal for a customs union with the EU on Tuesday to her cabinet committee on Brexit.

In the rear view mirror of last week we saw

Despite the UK Foreign Secretary Boris Johnson’s best efforts, President Donald Trump kept his promise of pulling out of the Iran nuclear deal, by ironically breaking the US’s promise of reducing sanctions in return for denuclearisation. As a result, the impending geopolitical tension in the Middle East, and tighter oil supplies for Iran saw the oil price spike up to its highest in roughly three-and-a-half years. Indeed, this benefitted Energy companies share prices, with the global Energy sector outperforming the wider global equity index by 1.40% last week (based on MSCI indices converted to sterling).

The Bank of England (BoE) kept interest rates on hold at their meeting on Thursday with a vote of 7-2 by Monetary Policy Committee (MPC) members. This was very much expected following the string of disappointing data we’ve witnessed for the UK. Despite the central bank reducing their inflation and growth forecasts, the MPC managed to strike a relatively hawkish tone. Much of their positivity was based on the belief that the disappointing first-estimate of first-quarter GDP will be revised upwards. As such, we would expect plenty of attention on the next estimate we receive when it comes to forecasting the potential next interest rate hike. It is released later this month on the 25th of May.

Core US inflation (as measured by CPI) came in slightly below forecast in April; however the annualised rate remains at a healthy 2.1%. Following this softer inflation reading, and the weaker-than-expected earnings growth from the last print, questions are being asked if the Federal Reserve (Fed) is nearing the end of their rate hiking cycle. St. Louis Fed President, James Bullard, spoke on Friday in which he outlined his view that no further interest rate rises are required.

In the side view mirrors of corporate activity we notice

Further signs of a struggling high street and weakening consumer confidence in the UK were evident following weak trading updates from both Greggs and JD Wetherspoon. The latter still maintained its full year expectations, however Greggs was met with more negativity with sales growth decelerating at a significant rate – the share price was punished as a result, dropping by 17%.

Shares in Apple last week hit yet another record high on the news that Warren Buffett increased his holding, with Berkshire Hathaway now Apple’s third largest shareholder of just under 5%. Investors followed suit after the legendary investor’s announcement, in which he stated “I’d love to own all of it” drawing attention to the fact that the company earns almost twice as much as the second most profitable company in the US.

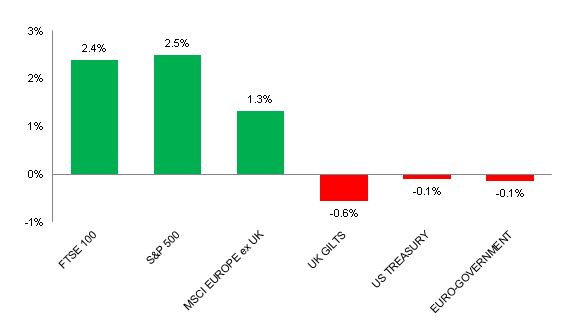

Source: Bloomberg. Figures are for the period 7th to 13th May 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.