8th April – 14th April 2019

- Date: 08/04/2019

Front and centre of our thoughts this week include

There's plenty to get excited about this week as another Brexit deadline looms. Central bankers will be in focus with the European Central Bank (ECB) holding a monetary policy meeting and the US Federal Reserve (Fed) releasing minutes from their March FOMC meeting. China also releases a number of important economic indicators and first quarter US corporate earnings season also gets underway.

The ECB's meeting is expected to be a quiet one and yield no change in monetary policy. Policymakers are becoming increasingly concerned over the sluggish pace of European growth, making it increasingly likely that interest rates will remain in negative territory for an extended period of time. As a consequence, the latest form of stimulus being discussed by the central bank is the introduction of a tiered deposit scheme to help mitigate the damaging impact that negative interest rates are having on the banking sector. Under a tiered scheme, banks will be partly exempt from being charged by the ECB to store their excess reserves, boosting their profitability and ability to lend. While this meeting may be too early for an announcement of this policy, expect ECB President, Mario Draghi, to face plenty of questions on the topic in his post meeting conference.

In China, the timing of the Lunar New Year always distorts economic data over the January and February period, making it difficult to establish a trend. This week sees the release of trade and lending figures for March, which should provide investors with a more definitive read on the health of the economy. The export figures will be closely followed for signs of the impact of US trade tariffs, while the lending data remains one of the best leading indicators of domestic demand.

The Fed will also release the minutes of their FOMC meeting held in March. As a reminder, it was at this meeting that policymakers completed an abrupt U-turn in policy, signalling interest rates are expected to remain on hold for the remainder of the year, down from their previous forecasts of two interest rate rises over 2019. The minutes should reveal how nervous policymakers are about the state of the economy whilst also highlighting what conditions are required for policymakers to deviate from their current "patient" stance. Separately, this week sees release of the Consumer Price Inflation (CPI) for March. The February reading showed consumer prices growing at their slowest rate in two and half years at 1.5%. However, the recent rise in the price of oil is expected to provide a boost to March's CPI figures, and consequently the annual rate of inflation expected to increase to 1.8%.

Finally, the first quarter US earnings season begins this Friday, with JP Morgan and Wells Fargo set to report results. According to Factset estimates, S&P 500 company earnings are expected to decline, on average, by 4.2% over the quarter. Should this materialise it would mark the first year-on-year decline in earnings for the S&P index since the second quarter of 2016.

Going on in the engine of Brexit

It's another pivotal week in the Brexit process. The government remains locked in talks with the Labour Party to try and reach a compromise on the Withdrawal Deal and Political Declaration and break the Brexit impasse.

Last week, Mrs May requested a further delay to the Brexit process until June 30th, to allow lawmakers more time to agree a withdrawal deal. Her request will be considered by EU leaders at an emergency Brexit summit on Wednesday. The approval of an extension looks likely, although it's still unclear what terms and conditions the EU will attach to any agreement. If no deal can be reached, the UK is set to leave the EU with no deal at 11pm this Friday.

In the rear view mirror of last week we saw

The latest service sector business confidence readings (known as the PMIs) for March should alleviate concerns over a marked deceleration in global growth. The Eurozone PMI readings provided further evidence that growth may be bottoming out, with Italy, Germany and Spain all showing an increase in service sector activity. The Chinese service sector PMI also rose to its highest reading since January 2018, with global data on the whole relatively upbeat.

The one major outlier to the positive trend in service sector sentiment came from the UK. The PMI here was considerably lower than anticipated, falling to 48.9 – any reading below 50 signals a contraction in activity in the sector. It is the first time the reading has fallen into contraction territory since July 2016. Given the fact the service sector accounts for around 80% of the UK economy, the weaker reading puts the economy at risk of suffering a marked slowdown in economic activity over coming months.

Over in the US, the closely watched non-farm payrolls (also known as the unemployment report) presented a picture of an economy in the "Goldilocks" environment of moderate growth and low inflation. The US economy added more jobs than expected in March, 196k (versus 177k expected). The better than expected reading should provide some comfort that the weak job creation in February was nothing more than a statistical anomaly, most likely driven by inclement weather or the government shutdown earlier in the year. Average wages, a good indicator of inflationary pressures, grew at a slightly slower annualised rate than expected, 3.2% (versus expectations of 3.4%).

In the side view mirrors of corporate activity we notice

Boeing could be facing several lawsuits that could potentially cost the company over $1bn. Investigators into the Ethiopian crash found that pilots initially followed Boeing’s safety procedures but were unable to regain control of the aircraft. The preliminary findings will add to pressure on Boeing after the same system was implicated in a previous deadly crash in Indonesia.

Saudi Aramco has revealed that it generated $111bn in net income last year, making it the most profitable company in the world. The company made its financial information available in a prospectus for a bond sale, as the company plans to finance a new corporate purchase. Whilst the enormous profits show the company has no need to borrow money, the group’s treasurer, Motassim Al-Ma’ashouq stated the company is borrowing as part of a strategic plan to enter public markets and eventually list a stake in the company.

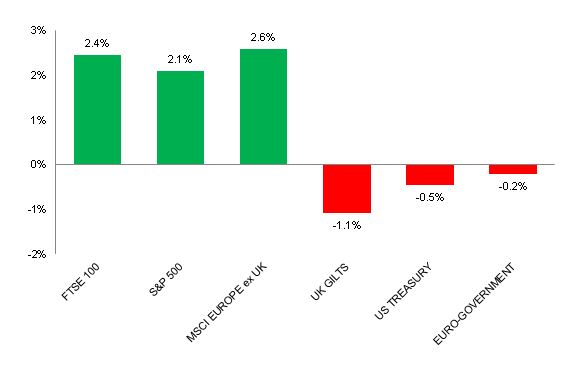

Source: Bloomberg. Figures are for the period 1st April to 5th April 2019.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.