29th April – 5th May 2019

- Date: 29/04/2019

Front and centre of our thoughts this week include

This week sees the start of May, so expect the well-known financial adage of “Sell in May and go away, and come back on St. Leger's Day” to appear in some analysts’ predictions for markets over the coming months. The phenomenon reflects the fact that historically equity markets have tended to experience some seasonality with returns typically higher over the October to April period than during May to September. The proverb seems to have an added significance this year given global equities have had one of their strongest starts to the year in decades but economic data has failed to show a meaningful pick-up in activity. It does feel that if equities are to edge higher from this point, we will need to see an improvement in both macroeconomic and corporate fundamentals going forward.

We will get a good insight into the health of the global economy this week through the release of the manufacturing PMIs from across the globe. Global manufacturing PMIs have been on a declining trend since the start of the year with Germany's, Japan's and South Korea's all in contraction territory. Investors expect China’s recent stimulus to lead to a revival in the manufacturing sectors fortunes. The stimulus so far has had a positive impact on China’s domestic economy but has failed to lift the growth trajectory of some of their close trading partners. The belief is that the stimulus will have a lagged impact on them and investors will be hoping for signs of this through a rebound in this month’s manufacturing confidence surveys.

Other important data releases this week include the US employment report (known commonly as Non-Farm Payrolls) for April. The US economy is expected to have added 185k jobs over April with wage growth expected to have increased to an annualised rate of 3.3%. US economic data has started to improve recently and another strong jobs report should provide investors with further assurances over the health of the economy. The Eurozone also releases its initial estimate of GDP growth for the first quarter of 2019, which is expected to show that the annual pace of growth slowed to 1%, down from the 1.1% rate recorded in the fourth quarter of 2018.

It’s also a busy week on the central bank front with the US Federal Reserve (Fed) and the Bank of England (BoE) holding monetary policy meetings. It’s a near certainty that neither will make any changes to their interest rate policy at the meetings. Whilst Fed policymakers are likely to take a more optimistic outlook for the economy in light of the recent improvement in economic data, it's unlikely that they will deviate from their "patient" message at their meeting. BoE members are also likely to keep interest rates on hold with the uncertainty over Brexit continuing to cloud the outlook for the UK economy. The Inflation Report, published alongside the meeting will give policymakers the chance to present their current forecasts for the economy and it will be interesting to see to what, if any, extent the recent postponement of Brexit has had on their outlook.

Politics will again be in focus with US officials in Beijing for further trade talks, with China officials scheduled to be in Washington the following week. Important issues still remain unresolved but both sides are aiming to have a draft agreement in place by the end of May. Given the material impact that the outcome of talks will have on global trade, expect investors to closely follow updates this week.

Finally, it's also a busy week on the corporate front with 166 S&P 500 companies set to report earnings for the first quarter of 2019. The highlights include tech heavyweights Alphabet (Google’s parent) and Apple.

Going on in the engine of Brexit

For once, it was not Brexit that dominated Westminster last week. Instead the scandal over who leaked the National Security Council’s decision to permit Chinese telecom company, Huawei, the right to build part of the UK’s 5G network stole most of the headlines.

Local elections on Thursday are once again likely to overshadow Brexit talks, with 8,425 council seats up for grabs. The local elections should provide a critical test for Theresa May and her Conservative party as it will be interesting to see to what extent her handling of the Brexit negotiations has lowered support for her party. Expectations are for the Tory party to receive a serious drubbing and potentially lose as many as 800 council seats. A thrashing of this kind in the local elections will only add further pressure to Theresa May’s already fragile tenure. In the background, talks are expected to continue with the Labour Party this week as both sides look to break the current Brexit impasse.

In the rear view mirror of last week we saw

The US economy surprised even the most optimistic of forecasts with the economy growing at an annualised rate of 3.2% over the first quarter of 2019, easily beating the 2.3% predicted. Whilst the stronger figure is a pleasant surprise, the underlying details of the report were not as strong as the headline suggests. Growth received a huge boost from a build-up in inventories and the increase in stockpiling is likely to slow activity in the quarters ahead. Furthermore net exports (exports - imports) added materially to growth but only due to a huge drop in imports while consumer spending, which accounts for roughly two-thirds of economic growth also slowed materially.

The general election in Spain has delivered a hung parliament. The governing Socialist Party won the highest share of seats, winning 29% of the votes, but fell short of winning enough votes for an outright majority. The party will now enter negotiations with other political parties to forge a coalition government with this likely to be a lengthy process.

In the side view mirrors of corporate activity we notice

The UK’s Competition and Markets Authority (CMA) has blocked the proposed merger of J Sainsbury and Asda. The regulator said the deal would lead to “increased prices, reduced quality and choice of products, or a poorer shopping experience” for UK shoppers. In an effort to get the deal approved, Sainsbury’s and Asda had proposed closing 150 of their supermarkets. However, the CMA concluded that there was no other way to address their competition concerns other than to block the merger. Both Sainsbury’s and Asda agreed to terminate the transaction after the announcement, with shares in Sainsbury’s sinking by 6% and to the lowest level since 1988.

The US first-quarter earnings season have got off to a solid start with an above average number of companies reporting better-than-expected results. The technology sector in particular has had a strong reporting season, with technology heavyweights Facebook and Microsoft both reporting higher-than-expected earnings. The better results pushed the valuation of Microsoft to above $1trn for the first time, becoming only the third company to have a valuation that exceeds $1trn at any single point (Apple and Amazon had previously reached this feat before the sell-off in the fourth quarter of 2018 lowered their valuations).

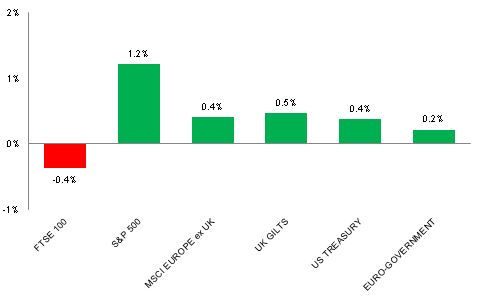

Source: Bloomberg. Figures are for the period 22nd April to 26th April 2019.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.