18th February – 24th February 2019

- Date: 18/02/2019

Front and centre of our thoughts this week include

Considering the theme for economic data has been one of recurring disappointment, plenty of our attention will be on the first look at February PMIs for Europe and the US, providing the latest insight into the health of their manufacturing and service sectors. The Eurozone is of particular concern with their Composite PMI falling nearer to contractionary territory (i.e. below 50).

Closer to home, the highlight for the UK in terms of economic data will be December’s employment report released tomorrow morning. With no change expected in the unemployment rate (holding at 4.0%) it will be the wage growth figures that are closely watched. Forecasts are for it to tick up further to 3.5%. We will be hoping this is the case, as the strength in wage growth coinciding with falling inflation in the UK has seen consumer confidence pick up, thus feeding through into strong retail sales – the latest update on this can be found below in the week-in-review. Clearly the Bank of England will be following both these series very closely as it considers its next moves on monetary policy.

Following weak retail sales data for the US (more on this below), data this week for the world’s largest economy will be highly scrutinised. This week sees the latest look at housing data, as well as durable goods orders to look for clues on business investment and further clarity on fourth-quarter GDP expectations.

Outside of economic data, the Federal Open Market Committee (FOMC) minutes from January’s monetary policy meeting are released on Wednesday. It was at this meeting where the Federal Reserve (Fed) adjusted their guidance from continuing gradual raising interest rates to one of patience following increased uncertainty around the economic outlook.

Finally, with no concrete signs of resolution after US-China trade talks last week, negotiations will continue into this week. We remain hopeful a deal will be done ahead of the 1st March deadline, preventing the US from raising China tariffs to 25% and further escalating tensions.

Going on in the engine of Brexit

Prime Minister Theresa May suffered yet another defeat in Parliament on her plan B for Brexit on Thursday, losing by 303-258 in yet another reminder of how difficult it will be to get a majority backing for a Brexit deal. Mrs May has now promised to bring (another) revised deal back to the House of Commons by the end of February, thought to be on the 27th.

Sterling unsurprisingly was down following the news of the defeat, weighed down following little signs of a break from this deadlock.

This week it’s looking like it is Jeremy Corbyn’s position that is to fall under the spotlight instead of Mrs May’s. Indeed, it’s been reported that a group of Labour MPs resigned from the party due partly to disagreements over his handling of Brexit.

In the rear view mirror of last week we saw

Very weak US retail sales for December spooked markets briefly on Thursday. Expected to rise +0.1% for the month, instead they plummeted -1.2%, the highest monthly decline since 2009. Due to the fact consumer spending accounts for the lion’s share of GDP, it resulted in economists revising GDP growth sharply down. Before the panic sets in, it’s worth remembering that this reading was the first estimate and will be revised twice more, with retail sales figures often heavily revised.

Some economists attributed the weakness to the fact that Thanksgiving fell earlier than usual last year, on 22nd November. It’s thought this resulted in the post-holiday shopping landing in the final week of November rather than the first week of December. We have less sympathy for this view considering that retail sales for the month of November were roughly in line with the average of November readings from 2009-2017 at +0.5%.

The UK on the other hand posted very strong retail sales figures for January on Friday morning, well ahead of consensus and shifting the annual rate to over 4%. Retail sales in the UK have been on a strengthening trend over the past 18 months, largely helped by the fact UK consumers have been experiencing real wage growth now since the beginning of 2018.

Germany was a whisker away from falling into a technical recession, as fourth-quarter GDP growth released last week was flat at 0.0%. However, whether it fell into technical recession or not isn’t really the issue – either way, Europe’s largest economy is suffering.

In the side view mirrors of corporate activity we notice

Royal Bank of Scotland’s (RBS) strong earnings confirmed the bank enjoyed a strong 2018 thanks to a reduction in both costs and bad loans, with pre-tax profit for the year up 50%, around £200m ahead of forecast. It also announced a much larger dividend than expected of 13p a share, 60% above analyst expectations. There are question marks over longer-term targets, however, as the company battles with the impact of Brexit uncertainty.

Coca-Cola shares were hit with their biggest one-day decline since 2008 on Thursday, largely due to their cautious tone surrounding the strength of the dollar’s impact on overseas markets. Shares in the US soft drink giant fell over 8% on the day.

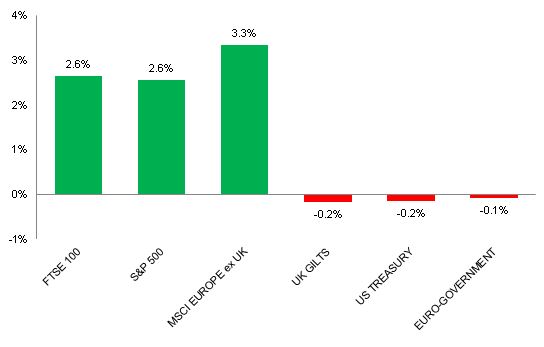

Source: Bloomberg. Figures are for the period 11th February to 15th February 2019.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.