11th March – 17th March 2019

- Date: 11/03/2019

Front and centre of our thoughts this week include

Kicking off with politics in the US – Donald Trump is due to present his 2020 budget on Monday where he is expected to spark another battle with the Democrats by asking Congress to provide $8.6 billion for his border wall. Of more importance to us, however, is the economic data that is to be released this week.

First we receive US retail sales for the month of January today. As a reminder, December’s retail sales were much weaker than anticipated – in fact, it was the lowest monthly reading since the 2008-09 financial crisis. Considering the poor jobs growth last month (more on this below), a second consecutive month of weak retail sales will only add further fuel to worries over the extent of the economic slowdown in the US.

Following retail sales, our focus for the US will then be on their inflation (CPI) report released on Tuesday. Considering some inflationary pressures have been building, most notably wage growth in the US picking up, the market will be keeping a close eye to see if this is feeding through into the inflation numbers. Having said that, consensus forecasts are for core CPI to remain at last month’s level.

Closer to home, UK Chancellor Philip Hammond is readying himself for his Spring Statement on Wednesday. Although, since the change he imposed himself, alterations to tax or public spending is kept solely for the Autumn Budget, there are some important snippets to keep an eye out for. Of particular importance will be the latest forecasts for economic growth and public finances. It’s expected the former is to be revised down considerably bearing in mind the Organisation for Economic Co-operation and Development (OECD) recently reduced their forecast for 2019 economic growth for the UK down to just 0.8%, well below the Office for Budget Responsibility’s (OBR) previous prediction of 1.6%.

Wrapping up this week’s key events is the Bank of Japan’s (BoJ) meeting overnight on Thursday to discuss changes to monetary policy. With no sign of any sustained economic growth or inflation, though, no change is expected as they look set to continue their extraordinary loose policy.

Going on in the engine of Brexit

We are expecting Brexit to dominate news flow this week, where we have Parliament voting on Tuesday regarding the Withdrawal Agreement Theresa May has re-negotiated. If it is rejected again there will likely be two further votes in the following days: (1) whether MPs want a no-deal Brexit, and (2) on an extension to the March 29th deadline. Indeed, with reports of a lack of any substantial changes made following re-negotiation, it’s looking unlikely Mrs May will gain enough votes to overturn the 230-vote deficit suffered in January.

Last night news broke that Mrs May is facing increasing pressure to essentially sacrifice her position as prime minister to win over support for her deal. The rationale is based on a lack of confidence in her taking on future trade talks between the UK and the EU.

In other Brexit news, the BoE has reportedly told some lenders to increase liquidity buffers in the run up to Brexit, as the real possibility of a no-deal remains.

In the rear view mirror of last week we saw

China’s National People’s Congress kicked off in Beijing early last week with some significant updates. First of all, as was widely expected, they altered their annual economic growth target from “around 6.5%” to “between 6.0% and 6.5%” in response to their decelerating economy. They also announced, in response to this slowing growth, a range of measures to help kick-start the economy in the form of tax cuts and infrastructure spending.

In Europe, the European Central Bank (ECB) met for their latest monetary policy meeting. The central bank announced new measures in order to stimulate the faltering economy. In what was a sharp shift in stance for a central bank very much focused on quantitative tightening (QT), it has now signalled that interest rates will be kept at the current historic low levels for the immediate future. Forecasts for the bloc’s 2019 economic growth were sharply cut to 1.1% from the previous forecast of 1.7%. Despite this, there were some positive signs for the Euro area last week with relatively strong PMIs for February, coming out ahead of expectations for most countries and for the Euro area as a whole.

The busy week was wrapped up with a surprising US employment report. Poor jobs growth got the headlines, with the economy adding just 20,000 jobs for the month, despite economists’ predictions of 180,000. Before getting too worried, it’s worth noting this does follow two consecutive very strong months. The other highlights were more positive, with the unemployment rate falling to 3.8%, and wage growth ahead of consensus. Although strong wage growth on the face of it seems like a positive, it does indicate that inflationary pressures are building at the time when economic growth is slowing, which isn’t a comfortable scenario for the US Federal Reserve.

In the side view mirrors of corporate activity we notice

Following the disclosure that two senior executives sold £20 million worth of their shares in betting company GVC (owner of Ladbrokes), investors were quick to follow them out the door with shares closing the day down around 14%.

Oil producing companies dragged the market down on Friday following the announcement that Norway’s sovereign wealth fund is to reduce its exposure to oil and gas stocks. The FTSE 100 was hit particularly badly as a result of the large exposure to energy companies. Shares in Royal Dutch Shell were down over -1.5%.

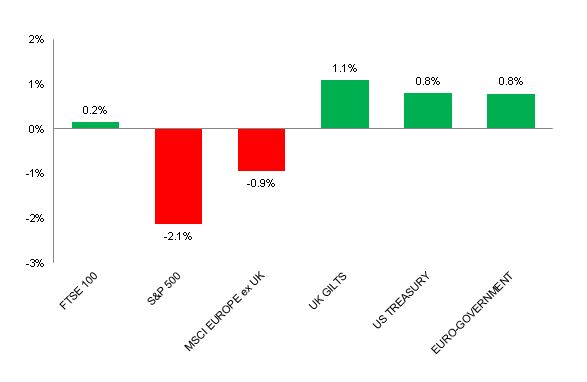

Source: Bloomberg. Figures are for the period 4th March to 8th March 2019.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.