16th April - 22nd April 2018

- Date: 16/04/2018

Front and centre of our thoughts this week include

This week begins in the shadow of the recent airstrikes over Syria which took place over the weekend. The action taken by the US, UK and France were well telegraphed, Theresa May will face questions on the UK’s involvement in the House of Commons this week. Markets appear to be treading water at the moment, not quite sure if robust economic growth will drag it through this rough patch or if recent volatility heralds the latter stages of the global economic cycle. Airstrikes over Syria and potential confrontation with Russia will not help to settle the nerves with investor sentiment as finely balanced as it is today. ▪ Geopolitical rumblings aside, markets typically look past shortterm noise which means investors will be trying to understand what the more medium term drivers might be. This week that will, to some extent, be guided by corporate earnings results in the US. This quarter’s set of results take on more significance as analysts attempt to decipher just how much more profitable companies have become since the recent tax reforms were implemented by the Trump administration.

As always with ‘earnings season’ we’ll get a real-time check on the health of the US consumer when the banks report. Last Friday JPMorgan, Citigroup and Wells Fargo reported broadly stronger than expected earnings but this week sees retail giant, Bank of America reporting. Analysts will be looking for clues within the consumer loans business – are consumers borrowing more money to buy cars, are they spending more on their credit card than they were last year? Today we’ll also see US retail sales data, thereby getting further insight into current consumer spending habits. ▪ UK inflation data will be released this week. The consumer price index (CPI) is forecast to be 2.7% for March, thereby continuing to hold beneath the 3% level recorded in January. The day before we’ll also see labour market data, where expectations are for the unemployment rate to remain at 4.3%. Much of the focus will be on wage growth data which has been a bit stronger in recent months.

These data will be important in the context of the upcoming Bank of England monetary policy meeting in May where there is a growing expectation that they will raise interest rates for only the second time since the great financial crisis. Inflation and the labour market remain key indicators in their dashboard. Should the data suggest rising inflationary pressures, we would expect a rate hike to become a formality next month.

Finally Chinese economic growth data for the first quarter of this year are also released this week. Forecasters expect the headline rate to remain stable at 6.8% (on an annualised basis) but there are some downside risks. Some of the leading indicators in China have weakened in addition to recent trade war spats with the US, will bring the Chinese growth story into greater focus this year and whilst we expect little impact in the short-term, they remain a concern for longer term growth in the economy.

In the rear view mirror of last week we saw

A tough week for Facebook founder and CEO Mark Zuckerberg who testified in front of both Congress and the Senate over allegations the company’s privacy laws had been compromised following the Cambridge Analytica scandal. He emerged with his reputation unscathed and indeed the share price of Facebook moved higher over the two days of testimony.

We received the minutes of the most recent Federal Reserve meeting last week, where the tone was relatively hawkish. One key takeaway was the relaxed attitude towards the recent trade war rhetoric, with the Committee noting that an increase in tariffs would not (in their current form) be enough to derail the US recovery. This attitude is in stark contrast to the European Central Bank meeting minutes which were released the following day. The Committee there noted that they were, in fact, worried about the US-China trade war and the potential negative impact on European economic growth.

Markets now expect a significant chance of another US interest rate increase at their meeting in June. This expectation has been propelled higher by the release of US inflation data last week. As measured by CPI, inflation dropped by 0.1% in March. However, when stripping out the volatile food and energy component (known as core CPI) inflation actually increased to 2.1%. This core figure is now a

In the side view mirrors of corporate activity we notice

It hasn’t been a great week for Chief Executives in the world of big business. Over the weekend it was reported that Sir Martin Sorrell is to leave WPP following an investigation into his conduct. Little detail has been released on this but he leaves behind the world’s largest advertising business where he has been in charge for the last 33 years.

Larger German companies have already identified leadership issues and spent last week rectifying their mistakes. At banking giant Deutsche Bank, the sword finally fell on John Cryan who oversaw a three year period where the bank struggled for profitability. At car manufacturing giant Volkswagen, Matthias Mueller was replaced as part of a broader managment overhaul following the diesel emission scandal in 2015.

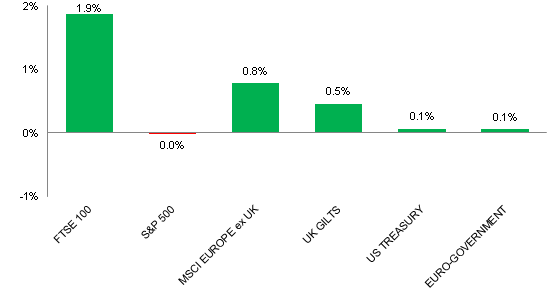

Source: Bloomberg. Figures are for the period 9th April to 15th April 2018.

Where the index is in a foreign currency, we have provided the local currency return.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.