9th July– 15th July 2018

- Date: 09/07/2018

Front and centre of our thoughts this week include

The week after the release of the monthly US unemployment report (more on that below) is typically quite light on economic data. This period of calmness in markets is only heightened as we usher in the high season for summer. With school holidays beginning over the next few weeks, investors will leave the cities for the beaches which lead to lower levels of liquidity in many assets.

The start of the week sees the May trade balance data for both Germany and the UK where an improvement is expected as each country’s respective export market continues to do well. We also will see how economic sentiment in Germany is holding up, where we will monitor for signs of impairment given the recent threats of a global trade war.

The recent trade war threats are unequivocally bad news for inflation. After all, governments that implement tariffs on goods will only force the overall price up. In that respect, the June release of inflation (as measured by CPI) for the two largest sparring governments in this spat (i.e. the US and China) will be an interesting preamble. Whilst the implementation of tariffs won’t feed through to the June data, should inflation appear to be already moving higher, it would force investors to think about potentially tighter interest rate policy for both countries.

The Bank of Canada is another central bank that will be explicitly considering the trade war spat when it convenes for its next monetary policy meeting. On Wednesday it will announce its interest rate decision, where economists expect a quarter point rise from the current rate of 1.25%.

We suspect the biggest driver of investor sentiment this week will be the beginning of the second quarter earnings reports for US companies. Pepsi mark the official start on Tuesday but matters only really get interesting when some of the big banks issue their reports at the end of the week. JP Morgan, Citigroup and Wells Fargo are all expected to post year-on-year improvements for the second quarter. Of most interest to investors will be the data on credit lending and whether borrowers are repaying their loans on time, important at this stage of the economic cycle.

It’s a very busy week for the global political elite, collectively clocking up more air miles than Santa Claus on Christmas Eve. Today Chinese Premier Li Keqiang will visit German Chancellor Angela Merkel while South Korean President Moon-Jae arrives in India for a summit with Indian Prime Minister Narendra Modi. Much of the increase in this week’s carbon footprint is due to a NATO leaders meeting near Brussels in the middle of the week. On the same day, Shinzo Abe, the Japanese prime minister will meet Jean-Claude Juncker and Donald Tusk to sign a free-trade deal with Europe (perhaps he could send a note on the matter to Theresa May or Michel Barnier?). By the time we get to Thursday, when we might have become bored by the political newsflow the UK media will be on red alert for the arrival of US President Donald Trump. He’ll meet the Queen and the prime minister, before he then is off to meet to Russian President Vladimir Putin in Helsinki.

In the middle of that political back and forth, we wait in eager anticipation of the final stages of the football world cup. With no British interest in either the singles men or women’s draw in week 2 of Wimbledon, the national pressure has cranked up on England to win their semi-final against Croatia. Might it be coming home? We’ll know this time next week.

In the rear view mirror of last week we saw

We were unlikely to get through this week’s edition without mentioning Brexit in some form or another. Last Friday Theresa May was able to bring her cabinet to an agreement on her vision for Brexit after a marathon meeting at Chequers, the PM’s country residence. Naturally what this vision entails is still quite opaque but overall it appears as though she has positioned for a softer Brexit, which sent Sterling higher.

For 48 hours it appeared as though there might finally be some harmony in the cabinet – that we might have a government united in approach to continue negotiations with the EU. Then late on Sunday evening Brexit secretary David Davis resigned, claiming that the new Brexit strategy was too soft. The pound has strengthened this morning implying that markets appear to have largely ignored the story. Of course that hasn’t stopped the UK media speculating, they now suggest that the PM’s leadership is in doubt, again.

The monthly release of US unemployment data, also referred to as ‘Non-farm payrolls’, for June delivered another blockbuster set of details. 213,000 jobs were created in the US last month with previous months revised higher, across a wide range of industries. The real economy and the demand for jobs from business is so robust that it is now tempting those who had previously considered themselves permanently unemployed to re-join the labour force. As a result, the unemployment rate actually went up to 4% (from 3.8%) because more people in the US now consider themselves available to work – this is known as the participation rate. Wage growth was a little softer than expected for the month but the annual rate remains near the high for the cycle at 2.7%.

In the side view mirrors of corporate activity we notice

More recently a number of global natural resource companies with large exposures to emerging markets have been exposed as engaging in bribery and corruption with domestic governments. The latest firm to face a US investigation is Glencore, the mining and commodity trader that is listed in London. It has been a turbulent period for the company and the subpoena issued last Tuesday detracted significantly from the company’s market value.

This morning the Co-op bank appointed their fifth chief executive in seven years. The bank are still overcoming the problems of the past few years, which culminated in a £700m rescue package last summer to end months of uncertainty about its future. Andrew Bester was at Lloyds Bank, where he had been cited as a potential successor to the CEO before he left in a restructure in 2017.

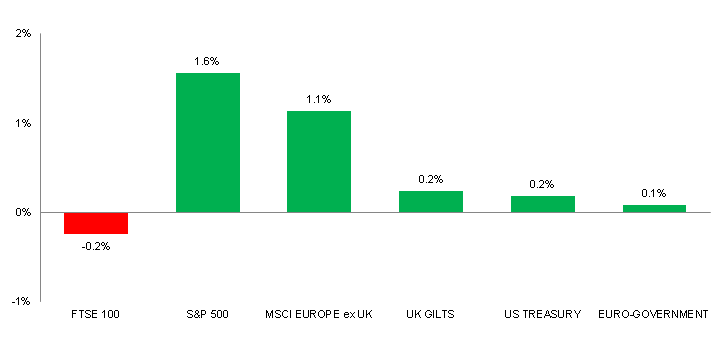

Source: Bloomberg. Figures are for the period 2nd July to 6th July 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.