7th May – 13th May 2018

- Date: 08/05/2018

Front and centre of our thoughts this week include

The week after the release of the US employment report (see below) is typically a little light for economic data releases and given it’s a holiday shortened week for those of us in the UK, could we possibly expect an easy ride? Clearly not. Politics, central bank meetings and corporate earnings will play an important role in setting investor expectations this week as markets face their first full week of May.

The corporate earnings season is still in full flight over in the US with many of the larger tech and financial constituents having already reported. Media giant Walt Disney report early in the week with questions expected around the upcoming acquisition of Fox. In Europe we’ll hear from German engineering company Siemens, quite often seen as a bellwether for European economic health. While over in Japan, the car manufacturer Toyota will report full year earnings where we’ll see what impact the stronger yen has had on sales.

Only a month ago the probability of a rate rise at this week’s Bank of England meeting was at over 80%. Fast forward to today and expectations have completely evaporated. Comments from Governor Mark Carney a couple of weeks ago which suggested a rate rise was not a done deal and terrible economic growth data in the UK for the first quarter have all contributed to the change in expectation. Should they retreat after painting a more aggressive picture of future interest rate hikes it will impair the Bank’s credibility going forward, loosening their control over financial markets. This Thursday’s meeting will conclude with a full press conference along with the presentation of the quarterly inflation report.

Donald Trump had generated a self-imposed deadline of this Saturday to make a decision on the Iran nuclear deal which limits the county’s nuclear programme in exchange for sanctions relief. The European nations who also co-signed the deal, namely France, Germany and the UK have tried to dissuade the US President, who feels the deal was not strong enough. Like many of Trump’s policies, he took to Twitter yesterday to bring forward this deadline to today when he will make an announcement. The noise around this has been enough to unsettle the oil price, pushing it up to over $70 per barrel last week.

In the rear view mirror of last week we saw

The US employment report (known as Non-Farm Payrolls) reached another record with the April report showing that the unemployment rate had reached an 18-year low of 3.9%, down from 4.1% in March. Whilst the gain of 164,000 jobs in the month was lower than the consensus expectation, the rebound in manufacturing employment was stronger after the weather related drop in March. The growth in wages was a little disappointing at only 0.1%, which leaves the year-on-year growth number at 2.6% where it has been for the last three months.

In Argentina the central bank sparked a furore by raising interest rates twice last week, with the borrowing rate moving up to 40% by last Friday, having only been raised to 33.25% earlier in the week. The central bank has been doing this to prevent the currency from weakening further against the US dollar, against which it is down 25% already this year. Whilst some idiosyncratic factors have triggered the recent currency weakness, some commentators are noting that emerging markets, more broadly, are feeling the pressure of a stronger US dollar and higher US interest rates. Emerging market governments typically have a significant proportion of their debt in US dollars.

We witnessed the return of mega-merger last Monday, hot on the heels of the potential Sainsburys-Asda tie up last weekend. This included the re-ignition of US mobile phone operator Sprint’s takeover of larger rival T-Mobile. The deal still faces significant regulatory hurdles as the major telecoms providers in the US will fall from four to three following the acquisition. Later that day Marathon Petroleum, a US oil refining company, agreed to take over rival Andeavor which would create the largest crude oil processor in the US. Today’s Monday merger news has already revealed that Shire, the UK listed Pharmaceuticals company has recommended to shareholders to accept a takeover from the Japanese drug company, Takeda. Should the deal go through it would mark the largest foreign acquisition by a Japanese company.

In the side view mirrors of corporate activity we notice

Over the last few years the electric car maker, Tesla, has found a lot of support from international investors despite the company not making any profit and not hitting production targets. That was until last week when founder Elon Musk criticised analysts on a quarterly conference call, whilst refusing to disclose information around the company’s financing needs. The share price sold off sharply in the aftermath.

Many of the large European banks reported their quarterly earnings last week (traditionally the US banks report much earlier after the end of the quarter), with the overall message being fairly subdued – again in contrast to their US rivals. Much of their underperformance has been driven by weakness in their investment banking operations where management changes and regulatory costs still continue to burden profitability.

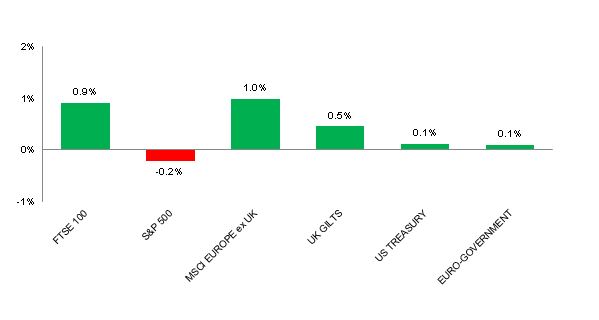

Source: Bloomberg. Figures are for the period 30th April to 6th May 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.