30th July – 3rd August 2018

- Date: 30/07/2018

Front and centre of our thoughts this week include

This weekend was a stark reminder of what the end of this glorious summer will look like when it does eventually arrive. For financial markets we can expect one last action-packed week before investors retreat for summer holidays. I will be taking some time off for shared parental leave and look forward to writing again in September. Until then I will leave you in the capable hands of my colleagues.

What a busy five days we have ahead for markets: central bank meetings; those ever-important monthly inflation readings; whilst the corporate earnings season in the US continues in full force. Then to top it all off, right at the end of the week, we’ll see the release of the US unemployment report which always keeps the shorter term traders busy.

The central bank merry go-round begins today with a two-day meeting for the Bank of Japan (BoJ). Policy makers at the BoJ don’t usually generate many headlines, so long has been the plight of deflation in the Japanese economy. Last week, however, saw government bond yields rise the most in two years as investors started to price in a move away from their ‘ultra-loose’ policy. The move higher in yields has put upwards pressure on global government bonds over the past week.

On Wednesday the US Federal Reserve meet with no change in policy expected. There will not be a post-meeting press conference nor an update to their economic projections. Consequently, the opportunity to move asset prices is relatively limited. The US economy has continued to grow at a robust pace, evidenced by the strong GDP reading last week (more on that below). Despite the housing market showing signs of softening, investors still expect two more rate rises in the US in 2018.

For many in the UK, all eyes will be on the Bank of England (BoE) when they meet on Thursday. The consensus expectation is for a quarter of a percentage point rise in the base rate which would take it to 0.75%. Should that happen it would mark the highest level of interest rates seen in the UK since 2009. Indeed so strong is the expectation of a rate rise from financial markets that anything less would be considered a surprise.

Investors will gain further clarity on the views of the Monetary Policy Committee (MPC) when Governor, Mark Carney, presents the quarterly inflation report in the post-meeting press conference. The BoE are trying to balance the current impact of Brexit against underlying growth in the economy, both of which are unclear and interdependent. Wage growth is improving, albeit slowly, while inflation has cooled a little in recent months which will benefit overall household income – providing some rationale for the MPC to hike.

Inflation readings are released in both the US and Europe during the week. Recent trends show they have been moving in the opposite direction with the US reading continuing to move closer to target while European readings have edged lower. Given the implications of these numbers for monetary policy, they are likely to be closely watched by investors.

Of greater consequence for markets at the moment are corporate earnings results in the US where this week 145 companies in the S&P500 will report second quarter earnings. Today sees US manufacturer Caterpillar report, often viewed as a proxy for global growth. The company noted in their first quarter report that profits would be at their “high watermark” as the impact of rising raw material costs would detract from future profitability. A telling sign that the trade wars are already having a negative effect on corporate America. After the disappointment of Facebook and Twitter earnings last week, Apple are due to report a rise in revenue this week. Equity prices in the tech sector have stuttered in the past couple of weeks and Apple’s results will be closely followed.

In the rear view mirror of last week we saw

Last Friday saw the release of second quarter GDP in the US, which was particularly high at 4.1%. Despite this number being slightly lower than consensus at 4.2% it was still 1.9% higher than the first quarter reading for economic growth – that is to say, it has almost doubled from the first three months of the year. The figure was driven higher by consumer spending and exports, suggesting that the US economy is on a strong footing.

The European Central Bank (ECB) kept their main refinancing rate at 0.0% at their monetary policy meeting last Thursday. Chairman Mario Draghi delivered an optimistic assessment of the health of the European economy, describing the growth path as “solid and broad-based”. The ECB confirmed that it would halve its quantitative easing programme, reducing the bond buying programme from €30bn to €15bn in September before ending all purchases in December.

The flash reading of the purchasing manager indices last week revealed little market moving detail, particularly for the Eurozone countries. The July numbers revealed that growth is continuing to slow in 2018, with the peripheral countries struggling more than their northern counterparts. In Japan, the manufacturing sector’s flash reading for July revealed its slowest growth in 20 months.

In the side view mirrors of corporate activity we notice

Despite the tech sector showing some signs of saturation, and admittedly this is more of a social media company story, Amazon continues to shoot the lights out when it comes to growth. Last week the online behemoth reported a record $2.5bn in second quarter net income, this time last year they reported $197m. This uplift has been achieved through the company growing its cloud computing division, Amazon Web Services.

Signs that the global trade war is starting to impact the price of goods continue to appear. Last week German carmaker BMW announced plans to raise prices for US-built cars that are exported to China, this after Tesla, the electric car maker, announced a similar plan the week before. For European automakers that have invested in US production facilities, the threat of a US-China tariff war will negatively impact profitability. Manufacturer of Mercedes-Benz, Daimler, is another European automaker that faced similar pressures when they issued a profits warning in June.

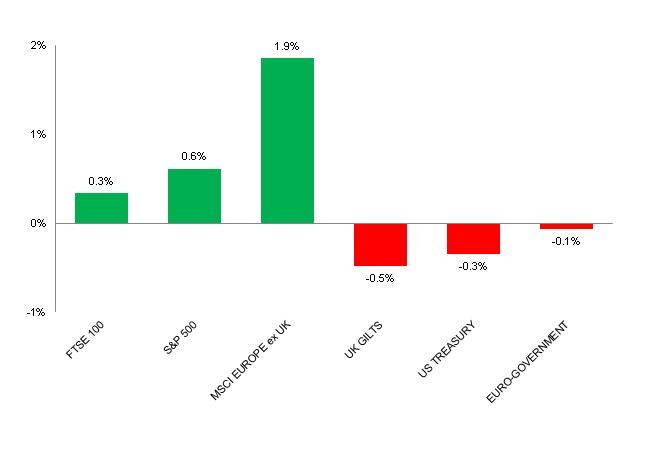

Source: Bloomberg. Figures are for the period 23rd July to 27th July 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.