24th September– 30th September 2018

- Date: 24/09/2018

Front and centre of our thoughts this week include

It feels like Autumn is starting to hit its stride this week, whether financial markets will cool down with the weather remains to be seen. Global politics is certainly heating up. From this week we are introducing a short section focused on our current thoughts around Brexit, which we hope will keep readers informed on recent machinations. If we’re lucky then we’ll be able to stop writing about Brexit on March 29th 2019…

As always we start by focusing on the economic data and this week is set for a fairly busy affair, albeit one that begins quietly. This morning the German business survey (IFO) was released for September and suggested a mixed picture, not that surprising given the on-going trade wars and Germany’s reliance on a well-functioning export market. Away from the data we may hear a few soundbites from various European leaders today, which will be interesting given the outcome at Salzburg last week.

The UN general assembly meet on Tuesday where Donald Trump will address them for the first time since he was elected President, given heightened tensions with trade partners as well as recently imposed sanctions on Iran it will be interesting to hear the tone of Trump’s speech. Markets will be more interested in the Federal Reserve’s (Fed) monetary policy meeting on Wednesday when it is widely expected they will raise interest rates for the second time this year by 0.25% to 2.25%. Much of the focus will be on the post meeting press conference when Chairman Jay Powell will present the Fed’s updated economic forecasts and the all-important “dot plot”.

The release of economic data picks up materially towards the latter half of the week. On Thursday we see the final release of second quarter GDP for the US which is expected to remain at 4.2% (on an annualised basis). Before that, we see inflation data (as measured by CPI) in Germany which could fall from its current level of 2%. Inflation data across the globe has been trending higher in recent months, illustrated by the spike in UK inflation last week (more on that below). More inflation data is set to be released for the Eurozone as a whole before the week is out.

Expect a fair amount of attention to be focused on the Italian Budget when it is presented by the government on Thursday. This is important for markets because the governing coalition have formulated bold policies to ease tax rates which would cause the government deficit to rise significantly and fall outside of the accepted parameters instilled by the European Commission in Brussels. Finance Minister, Giovanni Tria has been the one rational voice that has kept markets happy but any deterioration from his more orthodox approach could send Italian sovereign debt prices lower.

Going on in the engine of Brexit

Indeed the nervousness around the Italian budget situation is one reason why Theresa May has struggled to get any traction with her Chequers plan at Salzburg last week. In attempting to find a new hybrid version of the Norway model and Canada model for the UK, she is asking Europe to climb down from the rules that govern the membership of the Single European Market. The EU has one eye on populist parties gaining further momentum and the Italian budget story this week, which only further undermines the Prime Minister’s negotiating position.

Following the Salzburg meeting, the possibility of a no-deal Brexit seems as likely as soft Brexit, indeed all it has done is give further rise to more Brexit terminology – you can add ‘blind’ Brexit from last week to the current lexicon.

Attention this week will turn to the Labour party conference with 13,000 delegates expected in Liverpool. The question of the conference will be whether Jeremy Corbyn, the leader of the opposition, will commit to a second referendum on Brexit. Corbyn is facing an extraordinary amount of pressure from members of the party to pursue a second referendum, those same members who have voted him in as leader of the party. He will have to walk a tightrope this week which will culminate with his address to the party on Wednesday where he may be forced into providing clarity on the matter.

In the rear view mirror of last week we saw

Business sentiment surveys in Europe last week were broadly disappointing, largely driven by poor manufacturing data. The PMIs have been coming down since the year began after almost two years of improving sentiment from businesses across Europe. The service sector is displaying a bit more robustness but the overall story remains one of weakening business confidence. US business confidence has been on a strong upward trend for some time, however last week saw the service sector component of the PMI fall measurably for the first time.

UK inflation saw a material spike in August, much to the surprise of analysts, with CPI rising from 2.5% in July to 2.7%. The Bank of England had forecast for inflation to fall to 2.4%. Digging beneath the details shows that much of the uplift came from the more volatile components in the CPI basket, including recreation (notably theatre tickets and computer games), clothing prices and air and sea fares. There is some seasonality to these price rises and their volatility does infer much for the underlying picture for the UK economy.

In the side view mirrors of corporate activity we notice

Tesla CEO, Elon Musk is not the only leader (business or otherwise) to utilise Twitter as his communication medium of choice. However, over the summer the chief executive of the electric car company that is a publicly listed company, announced radical plans to take the company private via a ‘tweet’. This sent the share price higher (as much as 8.5%) before he later abandoned the idea. Last week the US Department of Justice opened an investigation, while Tesla now face lawsuits from investors.

Over the weekend Comcast has emerged as the highest bidder for the long-running battle to takeover Sky with a final offer of £17.28 per share. Details suggest that Comcast were happy to overpay to secure the deal while Fox (which is owned by Disney) were always going to be far more prudent.

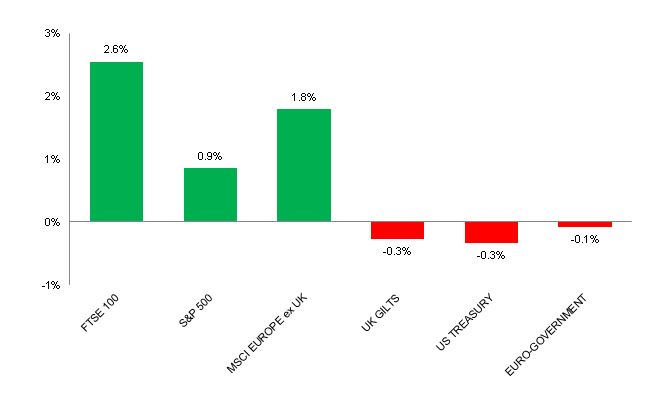

Source: Bloomberg. Figures are for the period 17th September to 21st September 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.