23rd April - 29th April 2018

- Date: 23/04/2018

Front and centre of our thoughts this week include

We have a jam-packed week ahead of us, which was kicked off earlier this morning in the Euro area where we received preliminary confidence readings for the manufacturing and services sectors, as measured by Purchasing Managers Indices (PMIs). As discussed in previous pieces, these PMIs have been disappointing for the region lately, as it seemed the market became overly-optimistic on the health of the economy. Looking at this morning’s releases, on-the-whole they were ahead of consensus and as such should re-inject some much-needed confidence back into the region. Having said that, these preliminary PMIs are first estimates and can be revised up or indeed down.

Staying with the Euro area, we also have the European Central Bank (ECB) meeting on Wednesday where they will announce their latest decision on monetary policy. No changes to interest rates are expected, particularly after seeing economic growth momentum and inflation disappointing lately. Instead, we expect to get an update on the central bank’s plans to wrap up their bond purchasing programme, which is expected to happen later on this year.

The Bank of Japan (BOJ) is also meeting. At risk of sounding like a broken record, no change to their monetary policy is expected.

In the UK plenty of attention will be focused on Friday when we get the first estimate of GDP growth for the first-quarter of 2018. This will provide the latest indication on the state of the UK economy – a topic that seems to polarise opinion at the moment. Optimists point to the strength of the labour market, positive real wage growth emerging, and government finances improving. Cynics, on the other hand, highlight that uncertainty surrounding Brexit continues to hinder business investment.

This release is one of the last key bits of data we receive before the Bank of England’s (BOE) meeting on 10th May where they will announce their decision on whether they are increasing interest rates or not. Following the data released last week (more on this below), there has been a significant reduction in the market implied probability for the BOE to increase interest rates at their May meeting. Prior to last week this probability was sat above 80%; however today this has fallen down to nearer 50%. Some of this fall in expectation has been driven by BOE governor, Mark Carney, speaking with BBC News following the softer data stating that markets were incorrect to believe a rate rise in May was a certainty. Looking forward between now and the central bank’s meeting, we would expect much focus to be on the UK’s PMIs released early next month.

Elsewhere on Friday we also receive first-quarter GDP growth for the US, where it’s expected growth will be slower than the previous quarter. This expectation is based on fairly lacklustre consumer spending.

In the rear view mirror of last week we saw

Geopolitical tension continued to swirl around last week with the US, China, North Korea and Syria all in the news. In the midst of this, followers of Mr. Trump on Twitter would also have noticed the US President accuse China and Russia of currency manipulation, while separately accusing oil cartel, OPEC, of artificially inflating the oil price.

It was an important week for UK data, as we received the latest employment report, inflation and retail sales. Each reading came as a surprise, either ahead or below consensus forecasts. Keeping it brief, the unemployment rate fell to its lowest since 1975 (4.2%), inflation undershot as core CPI fell closer to target (and to its lowest level in a year), while retail sales disappointed. The amalgamation of these was the catalyst for comments from Mark Carney, as discussed above.

Data from the US last week was relatively robust, including retail sales for March that held up following a poor start to the year. Away from data, it is also worth highlighting that Mr. Trump intends to nominate Richard Clarida, a Columbia University professor, as the new Federal Reserve Vice-Chair, a position that has been vacant since October.

In Europe, we received March’s finalised readings for Euro area inflation last Wednesday. This saw not only the March reading come down a touch to 1.3%, but February’s was also revised down to 1.1%.

The strength of China’s economy seems to continue to hold up strongly, with the latest GDP figure indicating growth of 6.8%.

In the side view mirrors of corporate activity we notice

FTSE 100 Consumer Staples giant, Unilever, reported last week. Despite what we thought were an encouraging set of results, which showed encouraging underlying sales growth (i.e. not taking foreign exchange into account) across all business segments, strong growth in emerging markets, a dividend increased by 8% and full-year forecasts unchanged, the market seemed less impressed. The share price was down around 2% on the day.

First-quarter US corporate earnings have kicked off strongly, aided by one-off impacts from the recently passed tax reforms as well as accounting changes that have artificially boosted earnings. According to Thomson Reuters, as of 20th April, 79.3% of the companies that reported had beaten analyst expectations. This week is a big one for US tech, where we have Alphabet (Google’s parent company), Facebook, Amazon and Microsoft reporting.

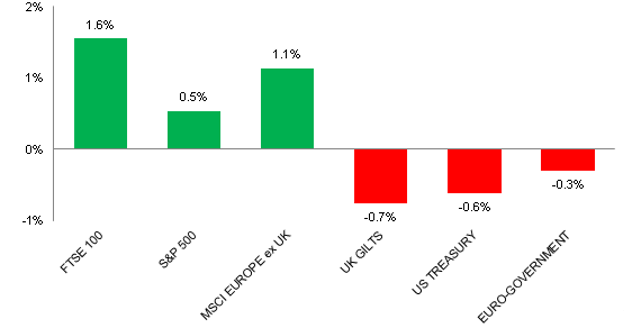

Source: Bloomberg. Figures are for the period 16th April to 22nd April 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.