20th August – 26th August 2018

- Date: 20/08/2018

Front and centre of our thoughts this week include

We have kicked off this week on news that Greece has completed its three-year emergency loan programme, which was part of the biggest bailout in financial history. Despite the milestone, the economy still has a long way to go before returning to a healthy status; however it’s certainly a step in the right direction. Regardless, we quickly turn our attention to the next potentially problematic event for the Eurozone: the Italian budget. There were reports last week that budget negotiations had begun, which spooked markets as investors sold off Italian bonds. A key threat of these tense negotiations, which are expected to be concluded by mid-October, is whether they stick within the fiscal limits that Brussels require.

Sticking with politics, the US is expected to impose new sanctions on Russia on Wednesday, before then imposing 25% tariffs on an additional $16 billion in Chinese imports. With China expecting to retaliate with 25% tariffs as well, we don’t expect these trade tensions to dissipate anytime soon.

With regards to noteworthy economic data to be released this week, the highlight will be first estimates of August Purchasing Managers Indices (PMIs) for the US, Eurozone and Japan. The PMIs will give us the latest look at how the three economies are progressing in the third quarter. PMIs for all regions have weakened somewhat the past few months, and current consensus is for little material change from July’s levels.

Another highlight for the week will be the release of the minutes from the latest Federal Open Market Committee (FOMC) and European Central Bank (ECB) meetings. We receive them on Wednesday and Thursday, respectively. With the Euro falling under pressure lately, discussions around a tightening of central bank monetary policy could well provide the currency with support.

The FOMC minutes may not prove as pivotal on Wednesday, as we have Federal Reserve (Fed) Governor, Jay Powell, making his first address at Jackson Hole on Friday. The annual conference will take place from Thursday to Saturday, with this year’s topic being “Changing Market Structure and Implications for Monetary Policy”. This economic symposium is a closely-scrutinised affair in terms of gaining insight into the Fed’s thoughts on future monetary policy.

In the rear view mirror of last week we saw

The latest UK employment report confirmed that the unemployment rate unexpectedly fell to 4.0%, the lowest level since 1975. Despite this strength in the labour market, wage growth actually slowed to an annualised rate of 2.4%. Unfortunately for UK consumers, as wage growth slowed, headline inflation rose for the first time since November 2017 to a rate of 2.5%, driven partly by transport fares. Having said that, the core inflation reading was unchanged from last month, at 1.9%.

Even though wage growth remains subdued in the UK, retail sales numbers released last Thursday indicated the UK consumer is holding up better than expected. Retail sales for July were significantly stronger than expected, rising 0.7% for the month, helped by the World Cup and the good weather we enjoyed.

On Tuesday we had the latest estimate of Euro area GDP growth for the second-quarter. This latest estimate showed an improved revision, with GDP growing 0.4% in the second-quarter.

Fears of an emerging market crisis continue to bubble, in a week where the Argentina central bank unexpectedly raised their overnight interest rate up to 45% to provide support for the Peso and to tackle inflation that is running north of 30%. Their currency crisis coincides with Turkey’s, as the Lira attempts to regain some of its substantial loss in value. With Turkey’s economy only making up a small portion of the global economy, it could be argued that potential contagion will not have a major impact on global growth. Having said that, one area for concern is Eurozone banks, with some significantly exposed to the country.

In the side view mirrors of corporate activity we notice

China powerhouse, Tencent, reported second-quarter earnings last week, which showed its first drop in quarterly profits in more than a decade. A key reason for the poor quarter was the increased regulation on their gaming business, with the state regulator freezing launches of new games. The disappointing news unsurprisingly saw the share price come under pressure, with the shares down as much as 5% on the day.

Royal Bank of Scotland (RBS) has now agreed a settlement of $4.9 billion over the miss-selling of mortgage-backed securities between 2005 and 2008. Now that the probe has been settled, RBS are moving on by confirming the interim dividend of 2p per share will be paid on October 12th.

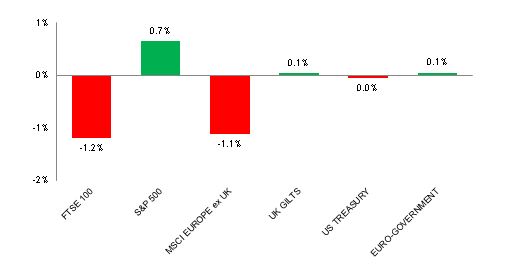

Source: Bloomberg. Figures are for the period 13th August to 17th August 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.