11th June – 17th June 2018

- Date: 11/06/2018

Front and centre of our thoughts this week include

This could be a week that defines 2018 with a series of high-level meetings, both economic and political in nature which will set the mood for investors and electorate alike. From Singapore to Whitehall, from Washington to Riga, before ending the week in Moscow, expect newspaper editors to be busy.

When the developed world’s central banks delivered us from financial despair with the introduction of the asset purchasing programme, in which they purchased billions of government bonds (more commonly referred to as quantitative easing - QE) at the height of the financial crisis in 2008, no one was quite clear on how it would all end. Well we’re near the end now but we’re still not quite sure if they have an agreed plan from which they are all working.

First up this week is the US Federal Reserve (Fed) who are expected to raise interest rates in the US by another quarter of one percent, bringing the short-term benchmark interest rate up to 2.0%. The market accounted for this and little in the past week has caused us to change our mind on this outcome either. As always the proceeding press conference will be watched for signs of further clues on remaining rate hikes this year.

Economic data in the US has been relatively robust in the past few weeks after a slightly wobbly start to the year. The one key missing ingredient in the US recovery has always been inflation (as measured by CPI) but that might be about to change. Before the Fed’s monetary policy meeting, members of that committee will get an early sight of the May reading for CPI where the headline figure is expected to rise to 2.6% (on a year-on-year measure). In a busy week for US data we will also see the retail sales report on Thursday where we continue to monitor the on-going health of the US consumer.

By the time we get to Thursday we’re back on the central bank theme, with the European Central Bank (ECB) holding their monetary policy meeting in Riga. Whilst no change in interest rates is expected, all eyes will be firmly on the accompanying press conference where many expect President Mario Draghi to discuss whether the ECB will end their QE programme in September. Should they formally address the topic at the meeting, we would expect bond markets to become more volatile – especially if the political noise out of Italy ramps up. There’s no rest for watchers of central bank meetings when the Bank of Japan meet on Friday, where analysts expect no change in interest rate policy nor to changes in their current QE programme.

It shall be a busy week in the Far East as US president Donald Trump is set to meet North Korean leader Kim Jong Un in Singapore on Tuesday. Whilst the meeting is significant for historical reasons and will capture the world media’s attention, there is little for financial markets to get excited about. One political story hoping to avoid media attention is the House of Commons debate and the vote which follows on the 15 amendments to the EU withdrawal bill put forward by the House of Lords. Should the vote not go through, expect Prime Minister May to suffer an onslaught from her peers, challenging her leadership.

If all of that wasn’t enough to whet one’s appetite for the week ahead, there’s the small matter of the football World Cup kicking off on Thursday with hosts Russia taking on Saudi Arabia in a battle of the oil producers. It is understood that Vladimir Putin and Crown Prince Mohammed bin Salman will discuss production targets on the day so we could expect headlines around the oil price too.

In the rear view mirror of last week we saw

The big news over the weekend was the fallout from the G7 meeting in Quebec. It was reported that relations had been frosty throughout, as tensions over trade tariffs implemented by the US surfaced in discussions. The joint communique that is typically issued post-meeting (and in truth, often quite vanilla in its wording) was ultimately rejected by the US. This after the Canadian Prime Minister, and G7 chair, Justin Trudeau, had described the US tariffs as ‘insulting’ at the closing press conference. As so often we see, President Trump took to Twitter to present his views calling Trudeau ‘dishonest and weak’. Then later on Sunday evening, members of Trump’s trade advisory team went even further on live TV using highly inflammatory words to berate the Canadian PM.

In some ways the weekend’s events make the Italian political merry-go-round seem relatively tame. On that topic, there was some better news over the weekend when the new Italian Finance Minister stated the new government were ‘clear and unanimous’ in their desire to remain in the euro area and there would be no ‘push towards an exit in any way’. These words helped the Euro to strengthen against the Dollar overnight and will be welcomed by European leaders ahead of a pivotal EU summit later this month on Eurozone reforms. Italian government bonds had another whirlwind week where pricing remains volatile despite the subdued political noise coming from the region.

The bad news keeps on coming for UK PLC. First of all last week we saw the government sell down 7.7% of its stake in RBS at a significant discount to the bailout price it purchased them at in October of 2008. Naturally this attracted criticism from the opposition parties who feel the Government should not be crystallising what will end up being a £2.1bn loss. Then UK department store, House of Fraser, announced the closure of 31 of its 59 stores including their flagship properties in London and Cardiff, putting around 13,000 jobs at risk. The high street has been under pressure for many years now as more people shop online, more recently Marks and Spencer announced similar measures as it suffers from declining footfall.

In the side view mirrors of corporate activity we notice

The technology sector has performed exceptionally well in recent years, last week saw Microsoft purchase an online company called GitHub utilised by millions of software developers. At $7.5bn the acquisition is one of Microsoft’s larger forays and suggests the company is moving to a more collaborative approach as it expands.

Finally last week saw the resignation of BT CEO, Gavin Patterson after five years at the helm. Despite recently announcing job cuts and potential cost savings, it was not enough to shake off shareholder worries. The share price jumped on the announcement of this resignation but still remains around their six-year lows.

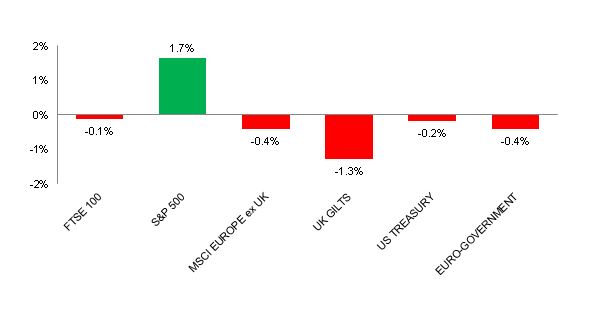

Source: Bloomberg. Figures are for the period 4th June to 10th June 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above charts provide the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.