10th September– 16th September 2018

- Date: 10/09/2018

Front and centre of our thoughts this week include

As we have mentioned in the past, the week following the release of the monthly US unemployment report (more on that below) is typically quite light on economic data. However there are two important central bank meetings towards the end of the week which will set expectations for interest rate policy in the UK and Europe. We’ll also see inflation numbers from Germany and the US before we get to the weekend when the party conference season kicks off with the Liberal Democrats down in Brighton.

On Tuesday domestic focus will turn to the UK unemployment picture when the Office for National Statistics releases data for July. The unemployment rate currently stands at 4.0% and as surveys suggest that this number is unlikely to change. Of more interest will be the wage growth data that is also released. Economists are forecasting wage growth to have risen in July by 2.5%, up from 2.4% in the previous month. Wage growth hit a high of 2.8% in February and has fallen since. A tick back up to 2.5% would be a welcome relief for the Bank of England (BoE) who are relying on improving household income to counteract higher interest rates.

On the same day we will also receive the reading on the German ZEW index, a monthly economic survey which measures analyst’s expectations for growth in the German economy. This index has dropped significantly in the past few months, having been positive as recently as March (and thereby indicating optimism) it is now negative and indicating pessimism. This change in sentiment has had a negative impact on the country’s equity market, the DAX, which is one of the largest fallers across Europe this year. An improvement in sentiment could help the DAX recover some poise going into year end.

Whilst no change is expected in monetary policy from either the BoE or the European Central Bank (ECB) this week, markets will be scrutinising every piece of detail from the accompanying statements on Thursday lunchtime. The BoE increased the base rate to 0.75% in August with all nine members voting for an increase. The futures market is not pricing in another rate hike until after March 2019, but this could move out further should the voting pattern from this week’s meeting appear particularly one-sided. The prices of UK gilts have sold off in the past month following the August meeting and there could be further downward pressure if the voting reveals a close split.

The ECB are also treading a fine line with respect to signalling on interest rate markets. President Mario Draghi has to contend with political strife in his native Italy, the potential escalation of trade tensions with the US, the risk of a ‘no-deal’ Brexit all whilst considering if the likes of Turkey pose a significant risk to Eurozone growth. Having presented a very upbeat assessment of the European economy at the last meeting where he suggested that an ECB rate rise could come ‘at the end of the summer in 2019’, Draghi will need to ensure that his language doesn’t commit the ECB to anything in error.

In the rear view mirror of last week we saw

The monthly US unemployment report always trundles into town like the circus, exciting the plethora of analysts on a Friday afternoon who hope to get a real-time steer on the direction of the US economy. Economists had expected the unemployment report to fall to 3.8% in August, however it remained at 3.9% as the economy added 201,000 jobs. The key take-away was the increase in wage growth which reached 2.9%, a figure not seen since June 2009 in the immediate aftermath of the financial crisis. Wage growth has been very sticky since the recovery, forcing central banks to put off increasing interest rates earlier. With the US Federal Reserve firmly entrenched in a rate hiking cycle, this piece of data confirms they are on the right path.

Strength in the US economy was very much a theme in markets last week as the release of business surveys for the service sector (known as the ISMs) revealed significant levels of optimism for business owners. It’s not just the service sector, which accounts for 80% of the US economy, that is seeing increasing confidence - last week saw a similar outcome for the manufacturing sector where the index has risen to a 14-year high. With the US dollar continuing to rally in the face of such strong indicators of economic growth, analysts are now warning of the dangers that a more expensive currency has for those exporting-driven companies.

In the side view mirrors of corporate activity we notice

The M&A bandwagon continues to roll on unabated as Coca-Cola announced they were buying Costa Coffee from FTSE 100 stalwart Whitbread. Costa had 39 branches in 1995 when Whitbread bought the company for £19 million, today it has 2800 stores with another 1400 overseas and is being sold for £3.9 billion. The sale of Costa will leave Whitbread to focus on the hospitality and leisure industry where they own Premier Inn hotels and Beefeater restaurants amongst a stable of other brands.

Amazon became the second company to reach the $1 trillion valuation point (also known as market capitalisation) after Apple got there only a few weeks before. The company was a highly publicised victim of the dotcom crash in 2001 when the stock hit a low of $5.97. Since then the company has evolved into a behemoth, taking on acquisitions as it seeks to provide the consumer with almost everything. The share price reached an all-time high last week of $2,047.46.

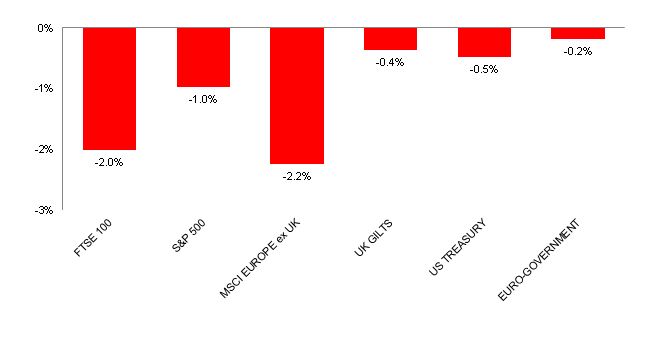

Source: Bloomberg. Figures are for the period 3rd September to 7th September 2018.

Where the index is in a foreign currency, we have provided the local currency return.

The above chart provides the performance for the three developed market geographies where the TMWM MPS portfolios maintain their largest exposure. All investments and indexes can go down as well as up. Past performance is not a reliable indicator of future performance.

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155). It is a company registered in England, number 08284862.

Weekly View from the Front

If you are interested in receiving this communication every Monday morning, please use the button below to fill in your details.

The value of your investment can go down as well as up, and you can get back less than you originally invested. Past performance or any yields quoted should not be considered reliable indicators of future returns. Prevailing tax rates and relief are dependent on individual circumstances and are subject to change.