High growth investment strategies for investors with 20 year plus time horizons

- Date: 08/02/2018

There is a simple message for those with a long time horizon wanting out-and-out growth - invest in equities. Short of starting up your own business, equity markets are the best opportunity for retail investors to capture the growth generated within our capitalist system.

For most investors the need for prudence comes before growth. If you need to rely on your investments, remember the hard lesson learnt by John Maynard Keynes, “the market can stay irrational for longer than you can remain solvent”. Therefore for most of us diversification is key, as is the prudent use of active managers to help smooth the volatility of the markets.

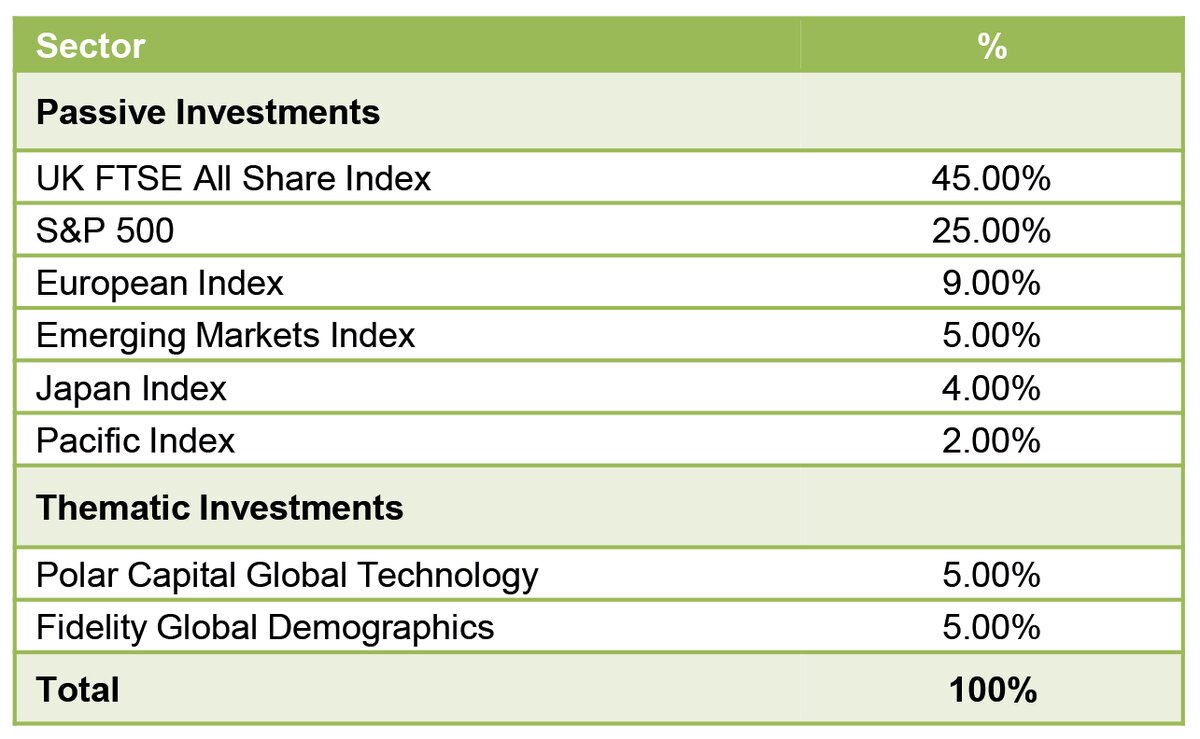

However in this case, we are unconstrained by the normal pressures of prudent financial planning or investment volatility; we are only looking for growth. Let us remember we are investing and not gambling. Therefore, direct and cheap exposure to the markets should provide the highest possibility for growth. We would retain significant exposure to the UK equity markets to help reduce some currency risk but also provide exposure to a broad range of overseas markets; notably the US, Emerging Markets, Europe, Japan and Asia.

In the portfolio above, we have complimented some of the US exposure to follow a thematic view; global technology. Technology stocks have outperformed the MSCI World index over a 20 year time horizon and the use of Technology has, or will, disrupt every industry on earth. We believe investing in technology companies will help drive portfolios forward over the long term.

Here it is worth utilising the skill of an active Manager and the Polar Capital Funds sits well with the passive equity exposure as it is more heavily weighted to mid cap companies; the most liquid and large passive indices, by their nature, are weighted toward large cap companies.

As a balance to the Technology Sector an investment in another theme, Demographics, provides a more predictable trend with lower volatility. For example, with ageing populations, healthcare stocks have the advantage of a growing market for their goods and services. Demographic funds are much wider in their brief than a pure healthcare play. They also invest in companies set to benefit from the rise of the middle classes in emerging markets.

We believe that Fidelity Global Demographics captures this theme well and has the research resources available to fully analyse the trend. In summary, invest in equities for growth, accept the volatility of passive investment if you can afford to and supplement this with capturing the real growth stories of the next 20 years – we are all getting older and the world is getting smarter.

Matthew Brown

Private Client Partner

Comments first appeared in:

Telegraph (on 8th February 2018)

Opinions, interpretations and conclusions expressed in this document represent our judgement as of this date and are subject to change. Furthermore, the content is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or a solicitation to buy or sell any securities or to adopt any investment strategy.

Thomas Miller Investment is the trading name of the businesses in the Thomas Miller Investment Group. This note has been issued by Thomas Miller Wealth Management Limited which is authorised and regulated by the Financial Conduct Authority (Financial Services Register Number 594155) and is a company registered in England, number 08284862.